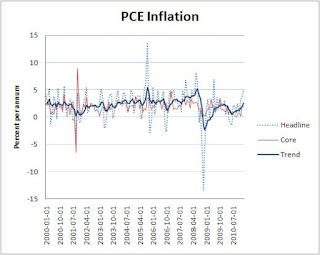

As almost everyone knows, inflation appears to be ticking upward. PCE inflation has recently approached an annual rate of around 5%. However, core inflation--the inflation rate that strips out the food and energy components of the consumption basket--remains relatively subdued (almost 2%, though it too has been rising as of late).

The Fed is widely understood to have an implicit inflation target of 2%. And the Fed has been known in the past for preferring the core PCE inflation measure over actual (headline) inflation numbers. With food and energy prices rising rapidly as of late, the reference to core inflation makes the Fed look out of touch with the prices consumers actually pay for their daily basket (food and energy make up about 25% of the average consumption basket).

What, if anything, justifies looking at price indices that strip out components of the index? A cynical view is that the Fed may prefer core to headline because it evidently makes the Fed's performance look better (in terms of keeping inflation low). This cynical view conveniently ignores the fact that headline inflation is frequently below core.

If you want to educate yourself about the issues surrounding the use of core, I recommend that you read this piece by Jim Bullard: Headline vs. Core Inflation: A Look at Some Issues. He starts as follows...

In terms of the use of core inflation, my own personal view leans toward dispensing with any inflation measure that strips out components of the consumption basket. If the main object of doing so is to get at some measure of "trend" inflation, then why not just compute a trend directly? For example, here is what one would get by using a simple exponential trend:

My crude measure of trend is not that much different from core. I doubt that there would have been any substantive difference in the way policy was actually conducted if reference had been made to this (or some other) measure of trend over the core measure. And an explicit reference to trend rather than core may have deflected the silly charge made by some that the Fed does not care about food and energy prices.

The Fed is widely understood to have an implicit inflation target of 2%. And the Fed has been known in the past for preferring the core PCE inflation measure over actual (headline) inflation numbers. With food and energy prices rising rapidly as of late, the reference to core inflation makes the Fed look out of touch with the prices consumers actually pay for their daily basket (food and energy make up about 25% of the average consumption basket).

What, if anything, justifies looking at price indices that strip out components of the index? A cynical view is that the Fed may prefer core to headline because it evidently makes the Fed's performance look better (in terms of keeping inflation low). This cynical view conveniently ignores the fact that headline inflation is frequently below core.

If you want to educate yourself about the issues surrounding the use of core, I recommend that you read this piece by Jim Bullard: Headline vs. Core Inflation: A Look at Some Issues. He starts as follows...

Monetary policymakers are responsible for maintaining overall price stability, which is usually interpreted as low and stable inflation. In order to decide on appropriate policy actions given their objective, policymakers need to know the current rate of inflation and where it is headed. What makes for a reliable predictor of future inflation has been debated throughout the years and continues to be the subject of economic analyses today.and concludes with...

In the end, the policymakers' goal is to use the inflation measure that helps them achieve low and stable headline inflation in the long run.In short, the Fed is not wedded to any particular policy-relevant measure of inflation. Many different measures should likely be used as input into any policy decisions.

In terms of the use of core inflation, my own personal view leans toward dispensing with any inflation measure that strips out components of the consumption basket. If the main object of doing so is to get at some measure of "trend" inflation, then why not just compute a trend directly? For example, here is what one would get by using a simple exponential trend:

Yes.

ReplyDeleteDavid,

ReplyDeleteHow about the Cleveland Fed's median CPI as an inflation measure? As I recall it uses the whole basket of goods but, being a median, would be less influenced by sudden and temporary price jump (i.e. shocks).

Since people are able and evidently willing to switch from prime rib to chop meat to rice and beans, the price of food and such may actually understate inflation. Consider some product where no one wants to settle for second best, something like health care; this may be the most accurate measure. Unfortunately.

ReplyDeleteI like the views that you offer of the Fed.

David,

ReplyDeleteMy understanding is that volatility in the stickiest prices is the most damaging, economically. Given the nominal wages are considered the stickiest price in the economy, why doesn't the Fed target nominal wages?

Thanks!

The more pertinent question may be is it time to replace Federal Reserve Notes and a system that is obviously out of control?

ReplyDeleteIt would appear this is being considered, and perhaps acted upon.

The Fed has basically trashed (debased) a currency once labeled 'Sound As A Dollar,' and it appears 'some' are indeed finding workarounds to a dated, and corrupt system.

http://abcnews.go.com/Politics/tea-party-momentum-utah-bill-brings-gold-standard/story?id=13377409

Is Gold the New Black? States Look to Bring Gold Standard Back

Utah is First State to Recognize Gold and Silver as Legal Tender; Inflation Worries Loom

By Huma Khan

April 15, 2011

Starting in May, Utah residents will be able to shop in a currency other than the dollar -- gold, something that hasn't happened since 1933.

Utah became the first U.S. state last month to recognize gold and silver coins minted by the federal government as legal tender. More than a dozen other states are considering similar measures, and are expected to follow Utah's example. The move, proponents say, is caused by declining faith in the U.S. monetary system and concern about rising inflation.

[. . .]

David,

ReplyDeleteWhat do you think of the textbook Macroeconomics, by Stephen Williamson?

Thanks,

U

Um, are academic formulae required?

ReplyDeleteThe real world.

Jim Grant On Inflation "There Will Be A Lot Of It Suddenly" Because Our Interest Rate Structure Is "Beyond Strange"

As for the gold standard: "If I am right about the dynamics of the Federal debt, not only is the mathematics for a gold standard compelling but so are the politics." In other words, and this should be no surprise to anyone, the transition to real money will continue until the fraud that is unbacked fiat is finally eliminated, with or without the Fed's support.

Prof J It's better than the current core measure!

ReplyDeleteAnon@2.31AM My understanding is that volatility in the stickiest prices is the most damaging, economically. Given the nominal wages are considered the stickiest price in the economy, why doesn't the Fed target nominal wages?

Your understanding is based on a particular theory that emphasizes the distortions created by sticky prices. I provide a critique of this theory here: http://andolfatto.blogspot.com/2010/07/sticky-price-hypothesis-critique.html

Anon@8.05AMThe more pertinent question may be is it time to replace Federal Reserve Notes and a system that is obviously out of control?

What is your metric for "out of control?"

Anon@3.17AMWhat do you think of the textbook Macroeconomics, by Stephen Williamson?

I like Steve's text and have used it in the past. But I like my own textbook better...lol.

Anon@8.47PM Jim Grant On Inflation "There Will Be A Lot Of It Suddenly" Because Our Interest Rate Structure Is "Beyond Strange"

Thank you for that insightful observation. Our interest rate structure is beyond strange. Yes, I see it now.

"As for the gold standard: "If I am right about the dynamics of the Federal debt, not only is the mathematics for a gold standard compelling but so are the politics." In other words, and this should be no surprise to anyone, the transition to real money will continue until the fraud that is unbacked fiat is finally eliminated, with or without the Fed's support."

ReplyDeleteThe nuts are out today. Greg Ransom, is that you?

From Anon@2.31AM:

ReplyDeleteDavid, I share your scepticism about sticky prices (and have read the post you referenced). But the Fed doesn't (cf. Yellen and Dudley's recent remarks) which suggests that by targeting core it is not being internally consistent.

Anon, you can always find members of the Fed who possess crazy ideas. But in any case, the point I was trying to make was not that core inflation (the way it is currently constructed) is necessarily a bad tool. My point was that it is a poorly understood tool and subjects the Fed to mindless criticism (like not caring about food and energy prices). My point was that the Fed could instead use some other tool (like my measure of trend) that essentially replicates what core does, but without the political hassle.

ReplyDeleteI think the Fed should just tell the masses to behave like good little tax slaves. (ya we like core what are you gonna do about it?)

ReplyDeletePaying more for fuel and food is fine as long as we make sure we keep wages the same and raise taxes to service more debt. Taxpayers need to be held accountable for bailing out TBTF banks! We also need to raise taxes so we can fund more wars....you don't want the terrists to explode your malls do you?

You think Americans care about which inflation indices is used? Just put Bernanke on Dancing with the Stars and all publicity problems will disappear.

Gabe, I didn't realize that the Fed declared or prosectuted wars or wrote the tax code.

ReplyDeletePlease explain.

Seems to me that you need to think about what you are trying to do. The ultimate objective of the central bank should not really be to control inflation. It should be to keep the economy at capacity. Measuring inflation is just a way of judging where you are. So the question becomes: "What inflation measure does the best job of indicating how close to capacity you are?"

ReplyDeleteYou want a measure that reflects domestic prices but leaves out, as much as possible, the influence of world prices and exchange rates. Wage inflation would do nicely, although the optics of the central bank keeping wage growth down might not be good.

There's no way the U.S. should be worrying about inflation now. What inflation you are seeing is generated by demand elsewhere and by currency depreciation. The U.S. economy is far below capacity.

Paul:

ReplyDeleteMy own view is that the objective of a central bank should keep control of inflation (keep it low and relatively stable).

I'm not sure if I agree with you that there is "no way" the US should be worrying about inflation now. There is evidence of an upward trend; and the wheels can come off suddenly.

How do you know that the US economy is "far below capacity?" I am not even sure what you mean by capacity here.

Perhaps I figure the U.S. economy is far below capacity because I read too much Krugman. But I don't really think so. He makes more sense to me than anyone else.

ReplyDeleteIn an April 16 blog post, he has a graph of wages, showing falling wage inflation. In a post today, he shows how the employment-population ratio has declined. I agree with his assessment that you have a liquidity trap situation. Here in Canada, things are a bit better and I hope we may have escaped a liquidity trap, but just barely. And I worry that another big U.S. contraction could be coming due to cuts in government spending.

I really don't think the U.S. should try to control this sort of inflation, which is generated by international price increases. Domestic inflation, particularly wage inflation, would indicate that the economy is being pushed too hard. But if the price of oil imports rises, it does not indicate any such thing. And if Americans are spending more for imported oil, they have less money to spend on things that create American jobs.

This sort of inflation makes the domestic economy contract. It is not an indication that it is being pushed too hard.

Paul:

ReplyDeleteYes, of course the E/P ratio has declined. Pretty severely too. Look here:

http://andolfatto.blogspot.com/2010/12/great-canadian-slump-can-it-happen-in.html

See, it happened in Canada too in the early 1990s. Do you think more inflation would have saved Canada from that slump? Personally, I doubt it.

Liquidity trap...what's that? Who cares? A swap of assets by the central bank has no effect? Big deal. The problem is low investment demand (that drives real interest rates low); and there are all sorts of reasons for while businesses are rationally holding back.

It's funny that you view US inflation coming from abroad. I have the exact opposite view; i.e., that US inflation is being kept so low only by the huge foreign appetite for USD and US treasuries!

I found your piece on the Canadian slump interesting. It might not be too hard to pin the blame for that on free trade, and the "giant sucking sound" of our jobs headed south. Not that I am opposed to free trade. I think that in the long run it is probably good, but not necessarily in the short term.

ReplyDeleteBut interest rates in that slump never got close to zero, and that's a very big difference to me. I don't get why you think it doesn't matter. Business investment is low as you said. All kinds of demand are low. The solution is more money in the bank accounts of real people and businesses to increase demand. Usually, the central bank can do that by buying bonds. That creates more money for borrowing. People take advantage of the lower interest rates and borrow money which gets paid to builders and their employees and suppliers, and gets out into the real economy through that channel.

When interest rates go to zero, it means that people don't borrow enough money even at zero interest to make this work. The channel through which the CB normally gets the money it creates out into the real economy is blocked. It can do QE, but that's just fiddling around the edges. Fiscal policy would work, but if you have a government that won't do fiscal policy, you have a big problem.

Paul:

ReplyDeleteYes, you are repeating the standard Krugman line here. I am not as sure as he appears to be about the root cause of the phenomenon.

Lack of demand. What's causing that? Fundamental or psychological? It makes a big difference in terms of policy prescription; and yet, it is very difficult to tell.

http://andolfatto.blogspot.com/2010/12/deficient-demand-deflated-balloon.html

My interpretation is that there is plenty of money for people to borrow. The lack of money, or liquidity in general, is not the problem. What the Fed is doing seems innocuous to me; see Steve Williamson's recent post "QE2 is Irrelevant."

The problem is that there is an a apparent lack of positive NPV projects out there. Firms and banks are sitting on cash. Having the government spend this cash is not likely to create anything but inflation. There appear to be real impediments in the way; not just psychological ones easily remedied by an increase in G.

"is an a apparent lack of positive NPV projects out there"

ReplyDeletehi david,

why do you say this? the reason i ask is that "capex" (i.e. 'equipment and software spending') in GDP is relatively high; the average q/q ar in the recovery has been 12.78%, which is high relative to the last expansion (6.9%) and even relative to the 95-00 tech boom (11.7%).

thanks!

Anon:

ReplyDeleteComponents of investment spending are definitely growing. But I'm interpreting investment more broadly. Residential, for example. As well, one could interpret a new hire as a form of investment (as it is in most search theoretic models of the labor market).

thanks for your reply. for sure, investment in "structures" is depressed, as one would expect. your point on human capital is more interesting (which is to say 'i hadn't thought about it in that way'!).

ReplyDeleteDavid, I share your scepticism about sticky prices (and have read the post you referenced). But the Fed doesn't (cf. Yellen and Dudley's recent remarks) which suggests that by targeting core it is not being internally consistent.visit my blog usagamezone.blogspot.com

ReplyDeleteWhile I agree with what you've said here in this article, I'm wondering... What (if anything) the common man/woman can really do to help this problem? Isn't this something that needs to be fixed on a higher level?

ReplyDeleteSandy

I'm always astounded that we can send men into space in flying metal cans but we can't figure out a standard formula that is consistently reliable to predict inflation. With all of the scientists and amazing minds in the world is this really that hard to figure out? So many people have great ideas- you for example but it seems impossible for the government to get their act together!

ReplyDelete