There are a lot of moving parts to the MMT program. I want to focus on one of these parts today: the relation between monetary and fiscal policy.

One thing I find appealing about MMT scholars is their attention to monetary history and

institutional details. I've learned a lot from them in this regard.

But as is often the case with details, one has to worry about whether they help

shed light on a specific question of interest, or whether they sometimes let us not see

the forest for the trees. And in terms of the broader picture, since I grew up

in that branch of macroeconomics that tries to take money, banking, and debt

seriously (i.e., not standard NK theory), I sometimes have a hard time understanding what all the fuss is

about. Much of standard monetary theory (SMT) seems perfectly consistent with

some of the ideas I seen discussed in MMT proponents; see, for example, The Failure to Inflate Japan.

This post is devoted to better

understanding a contribution by Eric Tymoigne. Eric is one of the people I go

to whenever I want to learn more about MMT (if you're interested in MMT, you

should follow him on Twitter @tymoignee). In this post, I discuss his

article "Modern Monetary Theory, and Interrelations Between the Treasury

and Central Bank: The Case of the United States." (JEI 2014). Passages quoted from his paper are highlighted in blue. The working

paper version of the paper can be found here. Eric has kindly agreed to respond to my comments and let me post our conversation. We had to some editing, hopefully this did not disrupt the flow too much. In any case, I hope you find it interesting. And, as always, feel free to join in on the conversation in the comments section below. -- DA

============================================================================

Perhaps what is meant is that MMT shows how existing self-imposed constraints on budgetary operations can be (or are) bypassed in reality. This leads us to question, however, concerning what those self-imposed constraints are doing there in the first place. Are they there by design and, if so, why? Or are they there by accident (and, if so, how in the world did this happen)?

DA: Eric, let's start with the opening paragraph:

One of the main contributions of modern money theory (MMT) has been

to explain why monetarily sovereign governments have a very flexible policy

space. Not only can they issue their own currency to spend and to service their

public debt denominated in their own unit of account, but also any self-imposed

constraint on budgetary operations can be easily bypassed.

I'm

curious to know what the contribution is here relative to standard monetary

theory (SMT). In SMT, the government can also issue its own currency to spend

and to service the public debt denominated in its own unit of account. So this

degree of "flexibility" is already accounted for. As for

"self-imposed constraints on budgetary operations," SMT takes several

approaches to this issue, depending on the purpose of the analysis. One

approach is to take these constraints as given and then to study their

implications. But it is also common to consolidate the central bank, treasury

and government into a single authority, which implies no self-imposed

constraints on budgetary operations.

Perhaps what is meant is that MMT shows how existing self-imposed constraints on budgetary operations can be (or are) bypassed in reality. This leads us to question, however, concerning what those self-imposed constraints are doing there in the first place. Are they there by design and, if so, why? Or are they there by accident (and, if so, how in the world did this happen)?

ET: Yes

consolidation is not unique to MMT as we have said repeatedly. Not only is it

used quite commonly in the economic literature, but also it is a common

rhetorical tool in economic talks, discourse, etc.

DA: Right, so everyone understands this (at least, they should)--it's perfectly consistent with standard monetary theory. So far, so good.

ET: Most

economists, politicians and the public don’t understand this or its

implications. They will interpret the above as saying that it is obvious that

the government can create money but it is not a normal way to proceed and it is

inflationary. MMT just pushes consolidation to its logical conclusions and

shows that institutional details do back those conclusions. In a consolidated

framework, the federal government can only implement spending by creating

money, this is not abnormal and it is not inflationary by itself. There is no

other way to find the necessary dollars to spend. Here is what consolidation means in terms of balance sheets:

For the federal government, taxes destroy currency

(L1 falls) and claims on non-fed sectors falls (A1 falls) (an alternative

offsetting operation is net worth of government rises). When US spends, it

credits accounts (L1 rises). Similarly, bond issuance does not lead to a gain

of any asset for the government; all it does is replace a non-interest earning government

liability (monetary base) with an interest-earning government liability (Treasury

securities).

DA: I am not going to argue against your accounting. As for bond-issuance, in

SMT, an open-market operation is modeled as a swap of zero-interest reserves

for interest-bearing treasuries. The interest on treasuries is explained by

their relative illiquidity (another self-imposed constraint). The economic

consequences of such a swap depends on a host of factors, which I'm sure you're

familiar with.

ET: Sure, in

addition, self-imposed financial constraints (e.g. debt ceiling, no direct

financing by the Fed, no monetary power for treasury) have been put in place at

various times with the argument that they impose discipline in public finances.

MMT argues, these financial constraints are not necessary and are bypassed

routinely through Treasury-Central Bank coordination.

DA: Sure, the standard view is that these

self-imposed constraints are designed to impose discipline in public finance.

The proposition that these financial constraints are or are not necessary, however, must be

based on a set of assumptions that may or may not be satisfied in reality. (The

fact that these constraints may be bypassed through Treasury-Central Bank

coordination does not seem relevant to me -- the conflict emphasized by SMT is

between an "independent" central bank and the legislative authority

(e.g., the Fed and Congress, not the Fed and Treasury). I'm not sure why a new

theory is needed here. We know, for example, that if the legislative branch of

government fully trusts itself (and future elected representatives) to behave

in a fiscally responsible manner, the notion of an "independent"

central bank (and other self-imposed constraints) makes little sense.

ET: Remember

that MMT emphasizes the irrelevance of financial/nominal constraints for

monetarily sovereign governments (bond vigilantes, risk of insolvency of social

security, etc.). One can do that by using the consolidated government (taxes

don’t finance, bonds don’t finance, government spends by crediting accounts,

etc.) or by using the unconsolidated government (the central bank helps the Treasury,

the Treasury helps the central bank). The second method conforms to actual

federal government operations but it is much less easy to use rhetorically and it

waters down the core point: government finances are never a financial issue as

long as monetary sovereignty applies.

Given that point, as you note, financial constraints are not only

irrelevant, but also disruptive and used for political games. MMT wants to make

government financial operations as smooth and flexible as possible. Once

society has decided how, and to what degree, government should be involved in

solving socioeconomic problems, finding the money should not be an issue when

monetary sovereignty prevails. That means demystifying

and eliminating financial barriers to government operations so the political

debate can focus on solving real issues (environment issues, socio-economic

issues, etc.). Fearmongering about the public debt and fiscal deficits makes for

poor political debates and policy prescriptions.

There is a view, expressed by Paul Samuelson, that if

we tell policymakers and the public that there are no financial limits to

government spending, policymakers will spend like mad; therefore, economists

need to lie to policymakers and the public (and themselves). This is nonsense.

We ought to discuss policy choices not on the basis of Noble Lies but rather on

the basis of sound and informed premises. Economists needs to make sure that

policymakers focus on resource constraints.

In addition, political constraints on government should be geared

toward improving the transparency and participatory aspects of government (e.g.

limit role of big money in elections, limit wastes, etc.). We already have a

government that passes a budget (it needs to do so for transparency and

accountability purposes), we already have an auditing process, and we already

have some (limited) democratic process, so aim at improving these aspects. MMT

proponents are not naive, we know that some politicians are self-interested, we

know that policy implementation may lead to mistakes, we know people may try to

game the system (“free riders”); however we trust that a transparent and

democratic government can (and does) get through these issues. MMT does not see

financial constraints as helping in any ways, rather they inhibit the

democratic process.

Of course, MMT proponents also have a policy agenda (Job guarantee,

financial regulation based on Minsky, etc.) because we do not see market

mechanisms as self-promoting full employment, price stability and financial

stability. As such, as you said, MMT proponents favor alternative means to

achieve these goals through direct government intervention. We don’t see the

central bank as an effective means to promote price stability. The central bank

should focus on financial stability through interest-rate stabilization and

financial regulation (an area where the Fed has not performed well).

Finally, yes independence

of the central bank is seen as a big deal but MMT disagrees for two reasons.

First, MMT emphasizes the lack of effectiveness of monetary policy in managing

the business cycle and, second, and probably more importantly, MMT notes that

central-bank independence in terms of interest-rate setting and goal settings

does not mean independence from the financial needs of the Treasury.

DA: I think it's fair to say most people want to see government

operations run smoothly, and would welcome a sober debate over the issues at

hand without the fear-mongering that some like to promote. The broad objective seems the same--the debate is more over implementation--how monetary and fiscal policy is to be coordinated--given human frailties.

Having said this, I think you go too far by asserting that

"government finances are never an issue as long as monetary sovereignty

applies." Of course, technical default on nominal debt is not an issue (we

all understand this). But SMT also recognizes the importance of economic default

on nominal debt. True, a government can always print money to satisfy its

nominal debt obligation, but if money printing dilutes the purchasing power of

money, this is a de facto default.

On a related issue, SMT asks "what are the limits to

seigniorage?" The fact that a government can print money does not give it

the power to command resources without constraint. People can (and do) find

substitutes for government money (they may also substitute out of taxed activities

into non-taxed activities). SMT treats the limits to seigniorage as a financial constraint.

Maybe MMT has a different label for this constraint? Perhaps it is related to

what I hear MMT proponents call an "inflation constraint." Maybe

one way to reconcile MMT with SMT on this score is by recognizing that SMT

usually assumes (sometimes incorrectly) that the inflation constraint is always

binding. If this is the case, a monetarily-sovereign government does have

a financial constraint, even according to MMT.

ET: Yes, ability to create a

currency does not mean ability to command resources because there may not be a

demand for the currency. That is where tax liabilities and other dues owed to

the government become important (cf. the chartalist theory of money, a

component of MMT). That’s also why taxes, monetary creation and bond issuance

are not conceptualized by MMT as alternative financing means but rather as

complementary. The government imposes a tax liability, spends by issuing the

currency necessary to pay the tax liability, then taxes and issues bonds. Spending may be inflationary

indeed and so there is an inflation constraint; but it is not a financial constraint,

it is a resource constraint.

About the “printing” of money

by government, inflation and economic default. Regarding the first two, there

is no evidence of an automatic relation between money and inflation. In a

consolidated view, government always spends by monetary creation but controls

the impact on inflation via taxes and the impact on interest rates via bond

issuance. In an unconsolidated view, the central bank routinely finances and

refinances the Treasury by helping some of the auction bidders and by

participating in the auction.

Finally, regarding economic

default, governments routinely “default” in that sense with no problems. I

don’t see that as a relevant concept unless someone can show that economic

default raises interest rates or generates rising inflation (it does not); here

again, there is no automatic link between inflation and interest rates. That

link depends on how the central bank reacts; if it does not then market

participants don’t either.

DA: Let me return to the manner in which the Fed/Treasury/Congress

are consolidated (or not) in SMT and why this matters, in your view. In some

SMT treatments, Congress decides spending and taxes, which implies a primary

deficit. It's up to the Treasury to finance that deficit, with the Fed playing

a supporting role (by determining interest rate and issuing reserves for

treasury debt). What's wrong with this approach?

ET: That goes in the

right direction with an understanding that the government really has no control

over its fiscal position. All this, which relates to the implementation of

monetary sovereignty, helps understand why the financial crowding out is not

operative, why monetary financing is not by definition inflationary, why i >

g is normal. It helps explain why the hysterical rhetoric surrounding the

public debt and deficits in nonsense. I recently wrote a piece for Challenge Magazine on that topic. Surpluses are celebrated, governments implement

austerity during a recession to “live within our means”, Social Security needs

to be fixed to avoid bankrupting it, governments need to save more, etc. All of this is incorrect.

DA: I'm not sure why you claim SMT leads to the idea of i > g.

The case i < g is perfectly consistent with SMT (see Blanchard's 2019 AEA

Presidential address, and also my posts here and here). The

correct criticism (I think) is that mainstream economists have assumed i > g

as being the empirically relevant case (it is not).

ET: That is what I meant. MMT links that to monetary sovereignty.

DA: I think that's correct. I should like to add that mainstream economists (apart from a small set of

monetary theorists) have not appreciated the role of high-grade sovereign debt

as an exchange medium in wholesale financial markets and as a global store of value, which in my view likely explains a lot of the "missing inflation." But as for

"surpluses being celebrated," you are now talking about individual

viewpoints and not SMT per se. There were plenty of calls out there

for countercyclical fiscal policy based on standard macroeconomic principles.

But I do agree virtually all mainstream economists are (perhaps overly)

concerned about "long-run fiscal sustainability." The view is that at

the end of the day, stuff has to be paid for -- and that having the ability to

print money, while granting an extra degree of flexibility, does not get around

this basic fact.

DA: I'd like to ask you about this statement you make:

In (the unconsolidated) case, the Treasury collects taxes and

issues securities before it can spend. However, federal taxes and bond

offerings also serve another highly important function that is overlooked in

standard monetary economics. Specifically, federal taxes and bond offerings

result in a drainage of funds from the banking system, and MMT carefully

analyzes the implication of this fact. From that analysis, MMT argues that

federal taxes and bond offerings are best conceptualized as devices that

maintain price and interest-rate stability, respectively (of course, the tax

structure also has some important role to play in terms of influencing

incentives and income distribution; something not disputed by MMT).

DA: Well, yes, taxes serve both as a revenue device

(permitting the government to gain control over resources that would otherwise

be in control of the private sector) and as a way to control inflation. I'm not

sure about the idea of the Treasury offering bonds for the purpose of achieving

interest-rate stability (though this may happen to some extent when the

treasury determines which maturity to offer). I don't think this is the way

things work in the U.S. today.

ET: Taxes and issuance of

treasuries drain reserves and so raise the overnight rate. Hence, on a daily

basis, a fiscal surplus raises the overnight rate and a fiscal deficit lowers

it. There has been significant Treasury-Fed coordination to smooth the impact

of taxes (and treasury spending) on the money market.

DA: Fine, but so what? We all understand

"coordination" between Fed and Treasury exists at the operational

level.

ET: I think you are too kind to other

economists and policymakers. On taxes as price-stabilizing factors, there is

indeed some similarities here. On the role of treasuries for interest-rate

stability, it does work like this today. It may not be obvious because of the

current emphasis on treasuries as Treasury's budgetary tools, but Treasury has issued securities for

other purposes than its budgetary needs. In the US, this occurred most recently during the 2008

crisis (SFP bills). In Australia, in the early 2000s, the Treasury issued

securities while running surpluses in order to promote financial stability.

DA: But even if this is not the way things actually work

(in my view, it's the Fed that stabilizes interest rates, possibly through OMOs

involving U.S. Treasuries), I'm not sure what point is being made. I think we

can all agree that monetary and fiscal policy can be thought of as being

consolidated in some manner. What would be good to know is how a specific MMT

consolidation matters (relative to other specifications) for a specific set of

questions being addressed. There is nothing in the abstract or introduction of

this paper that suggests an answer to this question.

ET: The point being made is that in a consolidated

government, tax and bond issuance lose the financial purpose

they have for the Treasury but keep their price and interest-stability purposes.

DA: In standard monetary theory, tax and bond issuance keeps

its funding purposes for the government and at the same time can be used to

influence the price-level (inflation) and interest rates. Is this wrong? I

don't think so. At some level, taxes (a vacuum cleaner sucking up money from

the private sector) must have some implications for the ability of government

to exert command over real resources in the economy. What we label this ability

(whether "funding" or ''finance" or whatever, seems

inconsequential).

ET: Ok here comes the crucial difference between financial

and real sides of the economy. In financial terms, taxes do not increase the

capacity of the government to spend, i.e. the government does not earn any

money from taxing; taxes destroy the currency. In financial terms, there is no

reason to fear a fiscal deficit; deficits are the norm, are sustainable and

help other sectors grow their financial net wealth. As such, it is not because a

government wants to spend more that it must tax more or lower spending

somewhere else. That is the PAYGO mentality. This mentality makes policymakers

think of spending and taxing in terms of how they impact the fiscal balance

instead of their impact on employment, inflation, incentives, etc. While

deficits may have negative consequences, they are not automatic. If

one takes a look at the evidence, deficits have no automatic negative impacts

on interest rates, tax rates, public-debt sustainability, or inflation.

In real terms, the necessity to increase tax rates to prevent

inflation, and so move more resources to the government, depends on the state

of the economy and the permanency of the increase in government spending relative to

the size of the economy. In an underemployed economy, the government

can spend more without raising tax rates. In a fully employed economy, shifting

resources to the government without generating inflation does require raising

tax rate and/or putting in place other measures such as rationing, price

controls, and delayed private-income payment. Here Keynes’s “How to Pay for the

War” provides the roadmap. Standard economics is full-employment economics so

opportunity costs are always present. MMT follows Kalecki, Keynes and the work

of their followers (have a look at Lavoie’s “Foundations of Post

Keynesian Economic Analysis”) and note that capitalist

economies are usually underemployment and economic growth is demand driven. Put

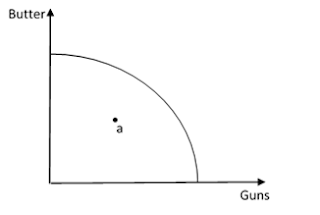

in a picture, the economy is usually at point a.

Put succinctly, the real constraint is conditionally relevant, the

financial constraint is irrelevant if monetary sovereignty prevails. That is

the proper way to frame the policy debates and to advise policymakers; don’t

worry about the money, worry about how spending impacts the economy.

ET: Moving to another topic, consolidation of the government brings to the forefront

forces that are operating in the current system but that are buried under

institutional complications. Namely that a fiscal deficit lowers interest rates

and treasuries issuance brings them back up, that spending must come before

taxing and treasuries issuance, that monetary financing of the government is

not intrinsically unsound and does not mean that tax and treasuries issuance

don't have to be implemented.

DA: The statement that "deficit lower

interest rates" needs considerable qualification. Among other things, it

depends on the monetary policy reaction function. As for the claim that

spending *must* come before taxes, this is not a universally valid statement

(even if it may be true in some circumstances. But even more importantly, who

cares? Mainstream theory does not suggest that monetary financing is

intrinsically unsound (seigniorage is fine, if it respects inflation ceiling).

As for money, taxes and bonds not being alternative "funding"

sources, I worry that this semantics. You can call X a "funding"

source or not -- it's just a label. The real question is: what are the

macroeconomic implications of X?

ET: Let me emphasize where I agree. Yes, evidence

shows the central role of monetary policy for the direction of interest rates,

fiscal policy is at best a very small driver. And yes, one ought to focus on

the real implications of government spending and we ought to forget about the financial implications. A fiscal

deficit is not unsustainable nor abnormal; deficits are the stylized fact of

government finances and are financially sustainable if monetary sovereignty is

present. So don’t try to frame the policy debate and set policy in terms of

household finances, bankruptcy, fixing the deficit, etc.

To conclude I see three reasons why the "taxes/bonds don't

finance the government" rhetoric is helpful:

1- It is strictly true for the federal government (i.e.

consolidation).

2- it brings to the forefront some lesser-known aspects of taxes

and treasuries issuance: impacts on money market, role of central bank in

fiscal policy, role of treasury in monetary policy.

3- It changes the narrative in terms of policy and political

economy: government does not rely on the rich to finance itself, taxes should

be set to remove the "bads" not to finance the government (e.g. one

should not set tax rates on pollution with the goal of balancing the budget but

with the goal of curbing pollution to whatever is considered appropriate, that

may lead to much higher tax rates than what is needed to balance the budget),

PAYGO is insane, one should focus on the real outcomes of government policies

not the budgetary outcomes.

DA:

1. I think this is semantics.

2. Not sure how it helps in this regard.

3. I think all of these positions are defensible without the

statement "taxes/bonds don't finance the government", so

if this is the ultimate goal (and I think it should be), perhaps we should set

aside semantic debates and focus on the real issues at hand.

ET: 1 is not semantic. I know you have in mind taxes as a

means to leave resources to the government. MMT makes a clear difference

between financial (ability to find the money) and resources constraint (ability

to get the goods and services) as explained above. The financial

constraint is highly relevant for non-monetarily sovereign governments so it

should be noted and clearly separated from the real constraint. Too many

policy discussions and decisions by policymakers operating under monetary

sovereignty are based on an inexistent inability to find money and the imagined dear financial

consequences of budgeting fiscal deficits. 2 helps to understand how monetary

sovereignty is implemented in practice. On 3, yes focus on the real issues.

DA: We agree on 3! Thank you for an interesting discussion,

Eric. There's so much more to talk about, but let's leave that for another day.

ET: You are welcome and thank you too!