There's been a lot of talk these days about whether unemployment in the U.S. today is the product of "cyclical" or "structural" factors. For example, see: And he huffed...and he puffed...and he blew the structural unemployment house down!

There's been a lot of talk these days about whether unemployment in the U.S. today is the product of "cyclical" or "structural" factors. For example, see: And he huffed...and he puffed...and he blew the structural unemployment house down! This blustering (by the big bad blog wolf) brings back a fond memory. In the fall of 1988, I had the good fortune of being enrolled in a PhD macro class taught by Peter Howitt. Peter had just returned from sabbatical leave (at MIT, if memory serves) and perhaps it was there that he picked up on the labor market search literature. (I should like to point out that he has a very nice paper on the subject, coauthored with Preston McAfee, published in 1987: Costly Search and Recruiting).

Anyway, it was in that class that the first learned of the "cyclical vs structural" debate. Evidently, the modern version of this debate started out with Lilien's "Sectoral Shifts and Cyclical Unemployment" paper (JPE 1982). Abraham and Katz countered with "Cyclical Unemployment: Sectoral Shifts or Aggregate Disturbances?" (JPE 1986).

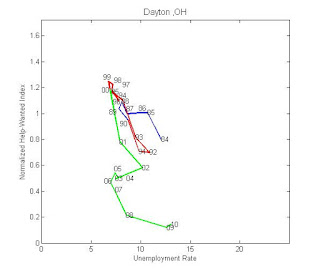

One part of the AK counterargument exploited Beveridge curve evidence. I understood their argument as saying that if structural shifts are the primary driving force, then one would expect to see a positively sloped Beveridge curve (much like what we are seeing right now in the U.S.). In fact, the Beveridge curve is negatively sloped. Ergo, aggregate demand shocks yes; structural shifts no.

As I had just finished reading Pissarides' now-famous AER 1985 piece, I knew exactly what AK were on about. And so, why not formalize the AK hypothesis in a Pissarides-style search model? (We were all scheduled to present a short seminar in Peter's class on a research topic, and this sounded as good as any). Now, let me describe the model I wrote down and what I discovered.

The model I used was a simplified version of Pissarides (AER 1985).

The economy consists of a fixed number of workers (mass normalized to unity) and a potentially "large" supply of jobs (or firms--I use the two terms interchangeably). Each job requires one worker. A firm-worker pair produce y units of output. (I assumed y to be common across matches, but allowed y to vary over time as an exogenous stochastic process).

Workers did not have any interesting decisions to make in the model. At any point in time, they were either matched with a firm or not. If they were matched, they produced output. If they were not matched, they used their fixed time endowment in search activity. Unmatched workers were "involuntarily" unemployed (because, by assumption, even menial jobs do not exist). Let u denote the unemployment rate at an arbitrary date (employment is given by n = 1 - u ).

Central to this literature is the notion of an aggregate matching function. The idea is that the aggregate recruiting intensity of firms (measured by vacancies v ) and the aggregate search intensity of workers (measured by unemployment u ) combine in some "black box" search market to produce an aggregate flow of new matches m. Formally, m = M(u,v), where M(.) was frequently specified as Cobb-Douglas (the rationale for CRS being that the ratio θ ≡ v/u displayed no secular trend in the data).

Now, Jeremy Greenwood had introduced me the year before to RBC theory. The idea there was that aggregate production possibilities, as measured by an aggregate production function y = zF(k,n) might bounce around owing to exogenous movements in aggregate productivity, z. It occurred to me that the AK hypothesis might be formalized by assuming that the efficiency of the aggregate matching function is subject to time variation owing to "structural" disturbances. That is, why could I not write m = xM(u,v), where x is analogous to the productivity shock in the RBC literature?

The idea is that a structural shock that (say) required sectoral or occupational reallocation is likely to reduce the efficiency with which matches are formed at the aggregate level (a lower x ). A lower x, in turn, would cause an "outward" (thanks, Nick) shift of the theoretical Beveridge curve, leading to the AK observation that structural shocks should induce unemployment and vacancies to move in the same direction. I was getting excited. But then, I was still young back then.

Alright then, back to the model. Following Pissarides, I denoted q ≡ m / v and p ≡ m / u as the match probabilities for vacant firms and unemployed workers, respectively. Utilizing the CRS matching technology about, we can write these match probabilities as functions of the "labor market tightness" variable θ (as well as the structural shock x, which I leave implicit). It turns out that q(θ) is a decreasing function of θ; more vacancies competing for the pool of unemployed reduces each firm's chances at making a match. Likewise, p(θ) is an increasing function of θ; more vacancies makes it easier for the unemployed to find work.

Firms and workers bargain over the output produced in a match. I assumed, for simplicity, that the wage is given by w = αy; where 0 < α < 1 is a parameter indexing the worker's bargaining power.

At the beginning of the period, the firm-worker match breaks up with probability 0 < σ < 1. Call this the separation rate. Let 0 < β < 1 denote the discount factor. If the value of a firm without a worker is normalized to zero, then the capitalized value of a firm with worker is simply the expected discounted stream of profits. If I let J denote the capital value today, and J+ the capital value tomorrow, then we have the following Bellman equation:

[1] J = (1 - α)y + (1 -σ)βE[J+ | ω]

The term E[J+ | ω] denotes the expected future value of firm operations, where the expectation is formed conditional on information ω.

Notice that I can embed the usual RBC assumption of persistent aggregate productivity shocks by assuming that ω = y. Or, we might model aggregate demand shocks as exogenous shifts in ω (my preferred interpretation is that these are news shocks). Absent any aggregate uncertainty, we can impose J = J+ and solve for the steady state capital value J*; i.e.,

[1a] J* = (1 - α)y / [1 - (1 - σ)β]

The next step is to figure out what determines aggregate recruiting intensity. Assume that posting a vacancy incurs the resource cost κ. Then, assuming free-entry in vacancy creation, the equilibrium labor-market tightness variable θ is determined by:

[2] q(θ)(1 -σ)βE[J+ | ω] = κ

The formulation above assumes that even newly created matches are subject to exogenous separation in the following period. In any case, note that since u is predetermined, condition [2] pins down equilibrium vacancies v. That is, v is a "jump variable" that responds instantaneously to any shock. If an increase in ω results in an increase in the value of a firm, for example, the effect will be to increase vacancy creation. As new vacancies come online, the probability of successfully finding a worker falls, until condition [2] is again satisfied.

Note that we can combine [1a] with [2] to determine the steady-state labor market tightness variable:

[2a] q(θ*)(1 -σ)βJ* = κ

Finally, we need an expression that describes the evolution of the equilibrium unemployment rate. This is given by u+ = u + σ(1-u) - (1-σ)p(θ)u; or

[3] u+ = σ + [ 1 - (1-σ)(1-p(θ)) ]u

The steady-state version of [3] is given by:

[3a] u* = σ / [ 1 - (1-σ)(1 - p(θ*) ]

That's it. What a beautiful little model. Note its lovely recursive structure: condition [1] determines J; given J, condition [2] determines θ; and given θ, condition [3] determines the unemployment rate.

Moreover, the model generates a nice downward sloping Beveridge curve. That is, an increase in aggregate demand (an increase in ω that increase J+) stimulates v, which reduces u. A structural shift that reduces matching efficiency (a reduction in x) shifts the Beveridge curve outward. Wonderful.

And so, following the RBC methodology I learned from Greenwood, I parameterized the model and calibrated the steady-state to some data. I specified the usual AR(1) process for the aggregate technology shock. And I added an AR(1) process for the match-efficiency (structural disturbance) shock. Then I simulated the model output for unemployment and vacancies under two scenarios. First, I shut down the structural disturbance, assuming only the TFP shock. And then I shut down the TFP shock, assuming only the structural disturbances.

To my surprise, both experiments generated downward sloping Beveridge curves (in the sense that unemployment and vacancies were negatively correlated). The correlation was a bit weaker under the structural shocks (something like -0.50 vs. -0.80, if I remember correctly). But the correlation was still negative! (I am going to assume that this was not the product of a coding error!)

In any case, during my class presentation, I explained the result as follows. Imagine hitting this model economy with a structural disturbance that manifests itself as a decrease in matching efficiency. In terms of condition [2], this is like a negative technology shock to the match probability q(θ). On impact, the unemployment rate remains fixed; hence, all the adjustment must be absorbed by the "jump" variable, vacancies. And if firms now find it harder to match, vacancies are going to jump down. The contraction in job availability then manifests itself as a higher (future) unemployment rate. Could the logic supplied by Abraham and Katz in refuting Lilien's hypothesis be wrong? Maybe.

Lessons

I don't want to make too much out of this simple model. One reason not to like it for the question at hand is that it is only a one-sector economy (though, my classmate, Paul Storer, eventually produced and estimated a very nice two-sector model here).

The point here is not to say who is right and who is wrong. Maybe the Abraham and Katz hypothesis is correct...or maybe it is not. I don't know. The important thing, in my mind, is what I learned from this experience; namely, to be very careful in accepting too quickly (or too uncritically) predictive statements based on informal stories.