You're probably thinking no, of course not. The dollar price of bitcoin can be quite volatile (see here). One can easily gain or lose 50% over a very short period of time. So if we're talking about an asset that offers a stable rate of return, Bitcoin ain't it.

Except that this is not what I mean by a safe asset.

I'm not even sure how to precisely define what I mean by safe asset. Loosely speaking, I'm thinking about an asset that people flock to in bad or uncertain economic times. In normal times, it's an asset that is held despite having a relatively low rate of return, perhaps because of its use as a hedge, or because of its liquidity properties.

U.S. dollars (USD) and U.S. treasuries (UST) are examples of safe assets today. Now, you might think that they're safe because they're close to risk-free in terms of what they promise in the way of a nominal rate of return. A paper USD promises a zero nominal interest rate and you'll be sure to get that if you hold on to the note over time (USD in the form of central bank reserves presently earn 1/2%, but only depository institutions get this rate.). A UST bill also promises zero nominal interest and you can be sure to get that with full principal repayment upon maturity. The coupon payments associated with a UST bond are virtually risk-free.

But that's not a complete way to think about the risk associated with a security. First, economists (rightly) focus on the real rate of return on an asset. Investors don't care how many paper dollars are promised to them in the future. They (presumably) care about the purchasing power of those future dollars. If inflation turns out to be high, that future purchasing power will be low. The opposite holds true if inflation turns out to be low.

As for the "risk free" UST bill, its market price will generally fluctuate between the issue date and maturity date. This is sometimes called "interest rate risk." If you buy a bill that promises $100 a year from now for $99, you will make about 1% if you hold the bill to maturity. But if market interest rates spike up in the interim, and if you are forced to sell your bill to raise cash, you're likely to realize a substantial loss.

That's the thing about a safe asset. It's return can appear to be stable for long periods of time and then--bam--something happens. (Something always happens.) Interest rates may spike up--a sudden sell-off in bonds may occur. What might trigger such an event? All sorts of news. Foreign banks may need to liquidate their foreign reserves consisting of USTs for political or economic reasons. A sudden increase in inflation expectations would lower the expected real rate of return on nominal bonds, inducing a sell-off. A bond sell-off might even be triggered by a good news event. An increase in productivity growth increases the expected return on private capital investment, inducing portfolio substitution out of bonds, for example.

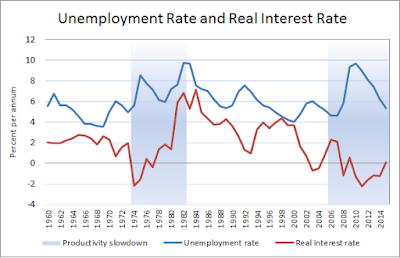

Another thing to keep in mind is that the asset classes that constitute safe assets can change over time. In my recent piece on secular stagnation, I noted that a "flight to safety" seems to occur near regime changes that imply productivity slowdowns. In 1974, investors flocked to gold and real estate--they ran away from USD (rapidly rising price-level) and UST (rapidly rising nominal interest rates). In 2008, the situation was quite a bit different--both USD and UST were highly sought after safe havens (with investors fleeing real estate).

The observations above suggest that the monetary policy regime matters a great deal for whether a fiat currency is perceived to be safe or not. When Nixon and his advisers chose to abandon the gold standard (against the recommendation of Fed chair Burns) in 1971, monetary policy appeared to lose its nominal anchor. So when the oil price shocks and productivity slowdown hit in the early 70s, investors ran away from cash. Gold is often credited as being a safe asset because of its supply "policy." But there must be more to it than this because, like gold, the supply of real estate is not very elastic. And yet real estate was not a safe asset in 2008.

Patience, Grasshopper. I will get to Bitcoin soon. Before I do, I want to ask "what makes an asset safe?" According to Gary Gorton, it has a lot (perhaps everything) to do with information asymmetry:

A "safe asset" is an asset that can be used to transact without fear of adverse selection; that is, there are no concerns that the counterparty privately knows more about the value of the asset. (Safe Assets, Working Paper, March 2016).

In other words, a safe asset is an object with attributes that traders can mutually agree on very quickly and at little cost. Objects with this property tend to become monetary instruments or, to use a more broad term -- exchange media (which includes objects commonly used as collateral to support lending arrangements). Safe assets tend to be "simple" assets. Historically, commodities such as salt, precious metals, or coined tokens. It's easy to verify your salary in salt (just taste it). It's a bit more difficult to assay gold. The whole purpose of coinage was to make objects easily recognizable without much effort.

It goes without saying that most financial instruments are complicated objects. Consider your life insurance policy, which is relatively simple as far as financial products go. The reason you can't buy your morning latte with a slice of that asset is because it's simply too costly for the vendor to do the necessary due diligence. So you pay in cash. Everyone knows what cash is. Cash may be "junk" (i.e., unbacked), but at least everyone can agree that it's junk. There's nothing complicated about cash. (The same principle holds true for UST, which are used extensively as collateral in overnight lending arrangements.)

Cash and gold are "simple" objects. The fact that they pay no interest makes them even simpler. In particular, there's no need to spend time investigating the reliability of a dividend paid by "barren" asset--everyone can agree right away that the dividend is zero. This type of informational symmetry appears to be in high demand in times of financial uncertainty (when nobody knows for sure what other people know about the securities they're selling.) Of course, the situation is somewhat more complicated when counterparties (intermediaries) are involved, but this is true of any asset.

This brings me to Bitcoin. I think that Bitcoin could be the world's next great safe asset. At least, it certainly seems to have all the properties that are desired in a safe asset.

Importantly, it is a "simple" asset. It's simple in the sense that it's a pure fiat object--the monetary objects (called bitcoin) constitute no legal claim against anything of intrinsic value. Bitcoin is simply a record-keeping technology (and economists have known for a long time that money is memory). It pays no interest. Possession corresponds to ownership (unless counterparties are involved). The ledger has proven itself secure (not a guarantee that is can never be compromised, of course).

Now one might object that Bitcoin is not that simple, not to the average person on the street, at least. Bitcoin consists of 30MB of C++ code. And the algorithm that governs the accuracy and security of the ledger can be hard to understand. But I liken this to the way most people understand how their car engine works. We have a vague notion of how internal combustion works, how power is transmitted through the drive train, blah, blah, but all we really know for sure is that our collective experience with the technology has proven useful. We also know that there are mechanics out there that do know how a car engine works. Because the Bitcoin code is open source software, attempts to modify the code for personal gain at communal expense are easily detectable through expert eyes. And we trust that there are many expert eyes on the watch.

Finally, Bitcoin has a very simple monetary policy. Essentially, the policy is to keep the money supply fixed (actually, it will grow asymptotically to a fixed number, 21 million units). Although this money supply rule could potentially be modified by communal consent, there are reasons to believe that this is unlikely to happen. And even if it does happen, it can only happen if it somehow serves the community of Bitcoin users in some broad sense.

As is well known, there's been a bit of a civil disturbance in the Bitcoin community as of late. The issue, as I understand it, concerns a proposed amendment to the Bitcoin constitution (see blocksize controversy). People fear that if the amendment does not pass (and it does not look like it will), then Satoshi Nakamoto's original vision of a low-cost, high-speed, high-volume P2P payment system may fail to materialize. Others are confident that a solution, in some form, will eventually be found. (These people breathe optimism, remember. It's the fuel that powers entrepreneurship.)

But suppose that the original vision doesn't pan out. Suppose instead that Bitcoin hits a hard limit on the volume of transactions it can process (presently far below what Visa can accomplish). Suppose further that as the subsidy on block rewards (the seigniorage revenue used to finance book-keeping costs) becomes negligible. Then a fixed transaction fee (and possibly a substantial one at that) will have to be paid, since someone has to finance the book-keeping costs. If this were to happen, then it would only make sense to hold Bitcoin for large-value transactions (the fixed cost associated with each transaction would make small-value transactions uneconomical.)

This "Bitcoin as a large-value transfer system" does not destroy my thesis: Bitcoin can remain a desirable safe asset. (Smaller players could presumably get involved by investing in Bitcoin ETFs, although doing so would introduce counterparty risk.)

I've argued before that Bitcoin makes for lousy money. I still believe this. If it isn't the unit of account, users are subject to extreme exchange rate volatility. In a world where it is the unit of account, a "flight to safety" event would cause an unexpected and severe deflation. We have the experience of the early 1930s to show us what a Bitcoin monetary policy can lead to. (And while a Bitcoin monetary system may free people from the inflation tax, it won't free them from more general forms of taxation.)

However, even if Bitcoin is not, in my opinion, a particularly ideal monetary instrument, this does not preclude it from serving as a safe asset or longer-term store of value. Once market penetration is complete, its return behavior is likely to mimic the return behavior of any other safe asset. Safe assets generally earn a low expected return (that is, they are priced dearly). Investors can expect to earn unusually high returns in a crisis event. But if you buy at the top, you can expect to realize unusually high losses when the crisis subsides. In short, it's a great investment -- assuming you can predict when a crisis will occur and when it will end!

There are a host of issues related to safe assets that I think deserve some attention. Let me offer a few that come to mind here. First, it's not even clear that safe assets are socially desirable. Bryant (2005) demonstrates that the existence of a safe asset can induce coordination failure. Is this an argument to be taken seriously? Second, I think that policymakers should be aware that the class of safe assets may change over time. Should policy be conditioned in any way on the existing set of safe assets? Third, how should we think about "close-to-safe-asset" substitutes that seem to proliferate in periods of prolonged economic tranquility? Barren assets like cash, gold and Bitcoin generate no income. It is evidently very tempting to construct "safe senior tranches" of private interest-bearing debt to compete with these low-return barren assets--a practice that sometimes gets out of hand--and with disastrous consequences. Should a central bank issue its own interest-bearing digital cash to discourage the practice?

Pasqua 2016