John Cochrane's blog has always been a favorite of mine. It's provocative. It's entertaining. And it invariably leads me to reflect on a variety of notions I have floating around in my head.

In his latest piece, he asks an interesting question: How does the Fed come up with its inflation forecast? What sort of model might be embedded in the minds of FOMC members? I like the question and the thought experiment. My comments below should not be construed as criticism. Think of them more as thoughts that come to mind in a conversation. (It's more fun to do this in public than in private.)

John begins with the observation that while the Fed evidently expects inflation to decline as the Fed's policy rate is increased, at no point in the transition dynamic back to 2% inflation is the real rate of interest very high. To quote John (italics in original): the Fed believes inflation will almost entirely disappear all on its own, without the need for any period of high real interest rates. Of course, this is in sharp contrast with the Volcker disinflation, an episode that demonstrated, in the minds of many, how a persistently high real rate of interest was needed to make inflation go down (some push back in this paper here).

John believes that the current inflation was generated in large part by a big fiscal shock in the form of a money transfer (an increased in USTs unsupported by the prospect of higher future taxes). I'm inclined to agree with this view, though surely there other factors playing a role (see here). John asks how this type of shock can be expected to generate a transitory inflation with the real interest rate kept (say) negative throughout the entire transition dynamic. Below, I offer a simple model that rationalizes this expectation. Whether it's the model FOMC members have in their heads, I'm not sure. (Well, I happen to know in the case of two FOMC members, but I won't share this here.)

Formally, I have in mind a simple OLG model (see, here). The model is Non-Ricardian (the supply of government debt is viewed as private wealth). The model's properties are more Old Keynesian than New Keynesian. The model is also consistent with Monetarism, except with the supply of base money replaced with the supply of outside assets (i.e., all government securities--cash, reserves, bills, notes and bonds).

So, I'm thinking about my model beginning in an hypothetical stationary state. The real economy is growing at some constant rate (say, zero). The supply of outside assets consists of zero interest securities (monetary policy is pegging the nominal interest rate to zero all along the yield curve). This supply of "debt" is also growing at some constant rate. Debt is never repaid--it is rolled over forever. Indeed, the nominal supply of debt is growing forever. New debt is used to finance government spending. The real primary budget deficit is held constant. The government is running a perpetual budget deficit via bond seigniorage; see here. The steady-state inflation rate in this economy is given by the rate of growth of the supply of nominal outside assets. (It is also possible that the inflation rate is determined by shifts in the demand for USTs; see here, for example). The real interest rate (on money) is negative.

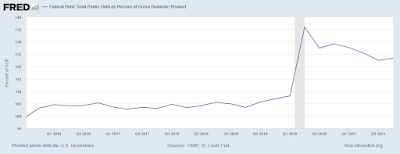

OK, now let's consider a large fiscal shock in the form of a one-time increase in the supply of outside assets (i.e., a helicopter drop of money that is never reversed). The effect of this shock is to induce a transitory inflation (a permanent increase in the price-level). An increase in the nominal supply of money at a given interest rate at full employment makes the cost of living go up -- it makes the real debt go down. And oh, by the way, the debt-to-GDP ratio is declining thanks in part to inflation:

This is despite the persistent negative real interest rate prevailing in the economy. I mean, what else might one imagine from a one-time injection of money? Is this is what the Fed is thinking? (This is what I'm thinking!) Note: an increase in the interest rate in this model would unleash a disinflationary force, but this would only serve to speed up the transition dynamic.

As it turns out, this simple story seems consistent with what I take to be John's preferred theory of inflation. The large fiscal shock here is unaccompanied by the prospect of future primary budget surpluses. The effect is to increase the price level (i.e., a temporary inflation). Maybe the Fed has John's FTPL model in mind?

Neither of these stories line up particularly well with the New Keynesian model, which emphasizes interest rate policy as *the* way inflation is controlled. There are, however, many strange things going on in this model. First, while no explicit attention is paid to fiscal policy, the fiscal regime plays a critical role in determining model dynamics (basic assumption is lump-sum taxes and Ricardian fiscal regime). Second, the Taylor principle that is needed to determine a locally unique rational expectations equilibrium is an off-equilibrium credible threat to basically blow the economy up if individuals do not coordinate on the proposed equilibrium (I learned this from John here.) By the way, Peter Howitt provides a different (and in my view, a more compelling) explanation for the "Taylor principle" here--published a year before Taylor 1993. Given these shortcomings, why are we even using this model as a benchmark? This is another good question.

John presumably picks this model because he sees no better alternative for modeling monetary policy via an interest rate rule. If he wants an alternative, he can read my paper above. Or, he can appeal to his own class of models extended to permit a liquidity function for USTs. These models easily accommodate stable inflation at negative real rates of interest. But whether this is how FOMC members organize their thinking, I'm not sure.

In any case, John picks an off-the-shelf NK model and assumes that it adequately captures what is in the mind of many FOMC members. Let's see what he does next (Modeling the Fed).

He writes: "The Fed clearly believes that once a shock is over, inflation stops, even if the Fed does not do much to nominal interest rates. This is the "Fisherian" property. It is not the property of traditional models. In those models, once inflation starts, it will spiral out of control unless the Fed promptly raises interest rates." [I think he meant "threatens to raise interest rates.]

Comment 1: I'm not sure what he means by a "Fisherian" property. (Note: the Fisher equation holds in the OLG model I cited above--though the real rate of interest is not generally fixed in those settings.)

Comment 2: Conventional models? I presume he means Woodford's basic NK model. It seems likely to me, however, that FOMC members may have other "conventional" models in their heads -- like the Old Keynesian model or the Old Monetarist model--both of which continue to be taught as standard fare in undergraduate curricula.

OK, so John considers a very basic IS-PC model and considers two alternative hypotheses for how inflation expectations are determined. The first hypothesis is a simple adaptive rule (see also Howitt's work above). The second hypothesis is perfect foresight (rational expectations) -- which, by the way, implicitly embeds knowledge of the Ricardian fiscal regime.

Under the adaptive expectations model, inflation explodes. Under the rational expectations hypothesis, inflation largely follows the Fed's actual forecast. Maybe this is what the Fed is thinking? The Fed has rational expectations?

Except that I'm not really sure what this means. John does give us a further hint though. He goes on to say "Not only is the Fed rational expectations, neo-Fisherian, it seems to believe that prices are surprisingly flexible!"

Right. So the Neo-Fisherian hypothesis is that to get a permanently lower rate of inflation, the Fed must (at least eventually) lower its policy rate (and vice versa to raise the rate of inflation). I've questioned this hypothesis in the past (see here). But what's going on here now? Is John suggesting that the FOMC is made up of closet Neo-Fisherians? Steve Williamson would no doubt be pleasantly surprised.

John writes: "The proposition that once the shock is over inflation will go away on its own may not seem so radical. Put that way, I think it does capture what's on the Fed's mind. But it comes inextricably with the very uncomfortable Fisherian implication. If inflation converges to interest rates on its own, then higher interest rates eventually raise inflation, and vice-versa."

No, I'm afraid the conclusion that inflation is transitory (even with negative real rates) is NOT inextricably linked to the Neo-Fisherian proposition. It is only inextricably linked this way in a class of economic models that: [1] are pretty bad; and [2] highly unlikely to be in the heads of most FOMC members.

Good post. It's really a shame that the only models that are taken seriously in these discussions are those that are 100 percent microfounded, because I think the transmission mechanism of monetary policy can be understood much more clearly in models that aren't forward looking.

ReplyDeleteBut instead we are stuck using models that have trouble explaining recessions, are opaque, and in which the transmission mechanism of monetary policy is ridiculous.

Thanks. I don't think this has anything to with microfoundations, per se. It's more a question of modeling choice (micro foundations or not). The canonical NK model is not the best model in our toolkit, in my opinion. But it can be appended in ways that make it more useful. And there are many excellent scholars making good use of richer versions of the NK model. It's just not my cup of tea, for reasons that I've explained many times in the past. :)

DeleteAt work, basically every model must be forward looking and have a whole lot of other bells and whistles in order to be taken seriously, which means that practically the NK model is all that is used.

DeleteA lot of discussions about how monetary policy works, the interaction between fiscal and monetary policy and the like can informed with really simple behavioural models (ie using such a model I found similar results to your paper on fiscal and monetary coordination), yet people prefer to simply use no models in cases where an idea can't yet be expressed in a forward looking context.