This is a follow-up to my earlier post: Employment Along the Canada-U.S. Border. In that post, I reported employment ratios and participation rates for three regions: Canada, U.S. states that bordered Canada, and U.S. states that did not border Canada. The main conclusion was that U.S. border states behave a lot more like non-border states, than they do Canada.

In this post, I (well, my fine research assistant, Lily, actually) report the same data but controlling for age and sex. In particular, I restrict attention to "prime age" workers--the age range 25-54 years old. I also divide the groups by sex. Here is what we get.

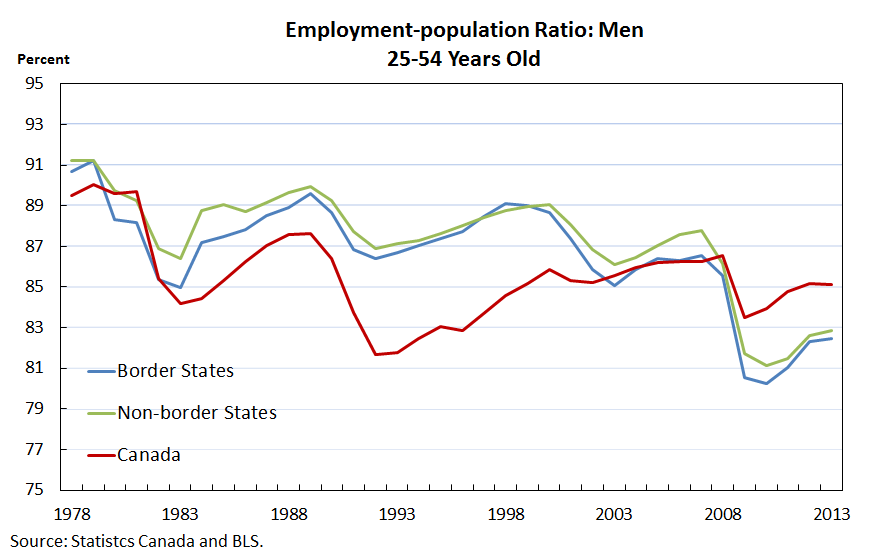

Participation rates for prime-age males has been declining steadily over time, but the decline seems to be much more dramatic in the U.S. Again, the border states follow their southern, rather than northern, counterparts.

The declining participation rates among men have been offset in part by the rising participation rates among prime-age women. Since about 2000, the participation rate among Canadian prime-age women continues to rise and remain stable, while in the U.S., the participation rate declines a bit. Again, the border states look more like their southern counterparts.

The great Canadian slump is evident in the 1990s. By the early 2000s, the employment to population ratio of prime-age males in both countries were roughly the same. The most recent recession hit the U.S. more severely than in Canada. Again, note that the border states followed their U.S. counterparts more closely than their Canadian neighbors.

According to this data, Canadian prime-age women were hardly affected by the recent recession.The pattern here is similar to the labor force participation rates described above.

While we can't say for sure just by looking at this data, I suspect that national policy differences are driving much of the different behavior here. But before I start looking for what these policy differences might be, I'll ask my trusty R.A. to look at sectoral decompositions.

In this post, I (well, my fine research assistant, Lily, actually) report the same data but controlling for age and sex. In particular, I restrict attention to "prime age" workers--the age range 25-54 years old. I also divide the groups by sex. Here is what we get.

The declining participation rates among men have been offset in part by the rising participation rates among prime-age women. Since about 2000, the participation rate among Canadian prime-age women continues to rise and remain stable, while in the U.S., the participation rate declines a bit. Again, the border states look more like their southern counterparts.

The great Canadian slump is evident in the 1990s. By the early 2000s, the employment to population ratio of prime-age males in both countries were roughly the same. The most recent recession hit the U.S. more severely than in Canada. Again, note that the border states followed their U.S. counterparts more closely than their Canadian neighbors.

According to this data, Canadian prime-age women were hardly affected by the recent recession.The pattern here is similar to the labor force participation rates described above.

While we can't say for sure just by looking at this data, I suspect that national policy differences are driving much of the different behavior here. But before I start looking for what these policy differences might be, I'll ask my trusty R.A. to look at sectoral decompositions.

Nice read! Very informative. Did you know that Chinese lead in online shopping? Full story here: http://on.fb.me/1gRKzis

ReplyDeleteDavid, off-topic, Mark A. Sadowski and I are trying to figure out a few things. Well, perhaps Mark has them figured out, but I'm not so sure:

ReplyDelete1. Reserves: does the definition of reserves include "vault cash?" Mark seems to think that vault cash can count towards satisfying reserve requirements, but that it is not actually "reserves."

2. Cash vs currency: I found one Fed document and several FDIC ones that draw a distinction: cash = currency + coin, with currency = paper money. Is this correct?

3. Interest of reserves? Does this apply to vault cash? It seems like it does not.

4. If currency is not the same as "coin" then does M1 include coins?

5. "currency in circulation": does it include "vault cash?"

Here's the whole conversation:

http://www.themoneyillusion.com/?p=26531&cpage=2#comment-332850

Does somebody at the Fed know the answers to these questions? (I know these are pretty low level details). There are plenty of links in that conversation to FRED graphs that Mark put together plus Fed documents and FDIC documents that we both found, and I can't figure it out. There seems to be some contradictions in there.

According to my colleague Dan Thornton:

ReplyDeleteHere are the answers. 1. Vault cash is reserves and counts towards meeting reserve requirements. 2. Correct, that is the common distinction. 3. No, only to deposits at Fed banks. 4. Yes coins are included. 5. No

David, thank you!!

DeleteTell Dan thanks too!... and maybe let him know that if you Google his name, it puts his picture up as the 33rnd governor of Colorado, now deceased.

Deletehttps://www.google.com/search?safe=off&site=&source=hp&q=Dan+Thornton&oq=Dan+Thornton&gs_l=hp.3..0l10.4470.4470.0.6952.2.2.0.0.0.0.172.295.0j2.2.0....0...1c.1.42.hp..1.1.123.0.w0PGHioLb4E

Also, you might want to let Dan (or someone) know this Fed online glossary (which is probably a bit dated) *may* have an error in its definition of M1:

Deletehttp://www.federalreserve.gov/pf/pdf/pf_appendixes.pdf

"M1

Measure of the U.S. money stock that consists of currency held by the public, traveler’s checks, demand deposits, and other checkable deposits."

It seems to me they should say "includes" rather than "consists of" or replace "currency" with "cash" so coins are included.

And for the record, Mark was never confused about most of that stuff: I misread him about 1 for example: he said vault cash was not part of "reserve balances" which I incorrectly took to mean "reserves."

DeleteBut the bit about IOR on vault cash was good info for both of us (and all of it was interesting to me... though I now have access to a basic macro book so I won't bother you again on basics). Thanks again.

Nice read! Very informative. Did you know that? P&G Picked a Tough Time to Expand Abroad. Full story here: http://bit.ly/1f5BnwT

ReplyDelete