CNBC interview with Congressman Ron Paul yesterday (April 28, 2011); click here.

The interviewer begins by quoting a statement Paul made after Bernanke's news conference:

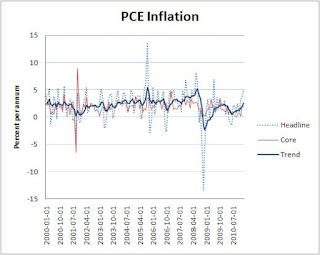

The average annualized rate of inflation over this time period is a dizzying 1.6%. Note the significant deflation experienced during the economic crisis. Ah, good times. The rate of return on your money was really high back then! I can recall clearly how savers were rejoicing...praising the Fed for the deflation.

PCE inflation measures the nominal price of a basket of consumer goods. You know, the stuff people buy to maintain their material living standards. This price index was actually falling in 2010. For better or worse, the Fed interprets "price stability" as 2% inflation. This explains QE2.

PCE inflation has recently jumped up to near 5%. This jump is attributable primarily to food and energy prices. Despite what some people like to believe, the Fed does not control food and energy prices (at least, not separately from other prices). Most economists attribute these relative price changes to geopolitical events and other temporary global shocks affecting the world supply and demand for food and energy.

It seems that what Congressman Paul means by inflation (judging by this interview) is "commodity price inflation." I think he must have in mind the price of commodities like gold. Why is the price of gold rising? Because people are dumping the USD and flocking to a "currency" they can trust.

Well, alright. There is probably something to this notion of currency substitution. If the Fed grows the money supply, its value must fall. The price of gold must rise. In the interview above, the Congressman claims that even grade schoolers can understand this (suggesting that Bernanke cannot).

Recent money supply and gold price dynamics seem to support Congressman Paul's hypothesis, which he states as some sort of obvious universal truth. But if this is so, then what explains the following data?

The graph above plots the price of gold and the (base) money supply over the 20 year period September 1980 to March 2001. As you can see, the Fed created a lot of money "out of thin air" over this 20 year period. The base money supply increased by over 300%.

Imagine that you are 50 years old in September 1980. Imagine that a trusted friend of yours--oh, let's say your doctor--convinces you to put all your savings into gold. The reason he offers is that the Fed is pursuing a policy of "relentless money expansion." He warns you that the money supply is set to grow by 300% over the next 20 years. So you listen to him.

You buy gold at $673 per ounce. And then you wait. You wait until you turn 70. And then you go to withdraw your savings. You discover that the gold price in March 2001 is $263 per ounce. That's a whopping rate of return of...wait for it... -60% over 20 years. That's a minus sixty percent.

All you kids understand now? Viva la gold standard! Class dismissed.

The interviewer begins by quoting a statement Paul made after Bernanke's news conference:

Bernanke continues to ignore his culpability for the inflation all Americans suffer due to the Fed's relentless monetary expansion.Let's take a look at U.S. inflation since 2008. Here it is.

The average annualized rate of inflation over this time period is a dizzying 1.6%. Note the significant deflation experienced during the economic crisis. Ah, good times. The rate of return on your money was really high back then! I can recall clearly how savers were rejoicing...praising the Fed for the deflation.

PCE inflation measures the nominal price of a basket of consumer goods. You know, the stuff people buy to maintain their material living standards. This price index was actually falling in 2010. For better or worse, the Fed interprets "price stability" as 2% inflation. This explains QE2.

PCE inflation has recently jumped up to near 5%. This jump is attributable primarily to food and energy prices. Despite what some people like to believe, the Fed does not control food and energy prices (at least, not separately from other prices). Most economists attribute these relative price changes to geopolitical events and other temporary global shocks affecting the world supply and demand for food and energy.

It seems that what Congressman Paul means by inflation (judging by this interview) is "commodity price inflation." I think he must have in mind the price of commodities like gold. Why is the price of gold rising? Because people are dumping the USD and flocking to a "currency" they can trust.

Well, alright. There is probably something to this notion of currency substitution. If the Fed grows the money supply, its value must fall. The price of gold must rise. In the interview above, the Congressman claims that even grade schoolers can understand this (suggesting that Bernanke cannot).

Recent money supply and gold price dynamics seem to support Congressman Paul's hypothesis, which he states as some sort of obvious universal truth. But if this is so, then what explains the following data?

The graph above plots the price of gold and the (base) money supply over the 20 year period September 1980 to March 2001. As you can see, the Fed created a lot of money "out of thin air" over this 20 year period. The base money supply increased by over 300%.

Imagine that you are 50 years old in September 1980. Imagine that a trusted friend of yours--oh, let's say your doctor--convinces you to put all your savings into gold. The reason he offers is that the Fed is pursuing a policy of "relentless money expansion." He warns you that the money supply is set to grow by 300% over the next 20 years. So you listen to him.

You buy gold at $673 per ounce. And then you wait. You wait until you turn 70. And then you go to withdraw your savings. You discover that the gold price in March 2001 is $263 per ounce. That's a whopping rate of return of...wait for it... -60% over 20 years. That's a minus sixty percent.

All you kids understand now? Viva la gold standard! Class dismissed.