The empirical BC is usually negatively sloped. Except for when it isn't. (You know how it is.)

The theoretical BC is a very intuitive creature. If some measure of general business conditions improve, especially in terms of economic outlook, businesses will generally want to expand their investments. And this includes investment in the form of replenishments to their labor force. If the labor market is subject to search frictions, the hiring process will take time. But an increase in job openings will generally make it easier for unemployed workers to find a job, so we would expect unemployment to decline as job vacancies rise.

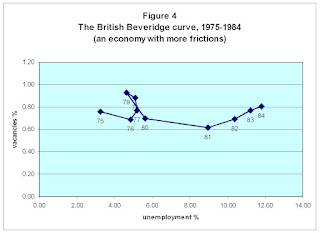

Sometimes, however, the BC appears to "shift" its position (e.g., if the BC looks like a shotgun blast). These apparent shifts are sometimes interpreted to be the consequence of shocks that somehow lead to increased search frictions (let me label these "structural" shocks). In his fine Nobel prize lecture, Christopher Pissarides gave the example of Brittain 1975-84:

Is this evidence of some greater difficulty in matching unemployed workers to available jobs? Did the recent recession leave us with some "structural" problems? If so, can we identify precisely what these "structural" problems are, and what--if anything--might be done about it? These are just some of the questions people are asking theses days.

Unfortunately, I'm not presently able to answer these questions. What I offer, instead, is some speculation on another question that has been floating in my mind lately. In particular, is the pattern of the U.S. BC plotted necessarily inconsistent with the notion that "structural" shocks have afflicted the labor market throughout the recent recession?

It was Steve Williamson's blog post here that got me thinking about this. Underlying much of the modern theory of search in the labor market is the Phelps/Pissarides aggregate matching technology:

[1] ht = xtM(vt,ut)

where h denotes hires, v denotes job openings (vacancies), and u denotes unemployment. For quantitative applications, M(.) is usually specified to be Cobb-Douglas; e.g., M(v,u) = v0.5u0.5. The x parameter corresponds to the TFP parameter in a standard aggregate production function. Following Steve, I use the JOLTS data to compute the matching function "Solow residual:"

[2] log(xt) = log(ht) - 0.5log(vt) - 0.5log(ut)

And here is what I get:

According to the plot above, events beginning with the recession have reduced matching function efficiency by about 20%. That's a big drop. But what does it mean? It's important not to get too carried away with this result. In particular, we have all the usual measurement problems to contend with when constructing TFP measures. For example, much or perhaps even most of the decline in measured TFP may be the consequence of (unmeasured) reductions in search intensity.

On the other hand, there does not appear to be any good reason to simply dismiss the result as evidence of increased search frictions. We just lived through an episode that tore apart many ongoing relationships. Picking up the pieces and putting them back together again (possibly in new and more productive ways--re: Schumpeter's creative destruction) may be a bit more difficult this time around. Ultimately, I think we will need to examine the microdata to assess the "disruptiveness" of the recession. Perhaps a study along the lines of Rogerson and Loungani (JME 1989)--who look at PSID data--might shed some light on the matter.

But until then, if we take the measured TFP data seriously (and, again, I emphasize the caveats), might this warrant reinterpreting the U.S. BC in the following way?

The red dots represent the empirical BC since the beginning of the recession (Dec 2007); the time when the estimated matching function TFP appears to weaken.

It is interesting, I think, to examine this interpretation in the light of a simple labor market search model. In an earlier post, I argued that a negatively sloped BC is not inconsistent with a sequence of shocks that deteriorate matching efficiency; see here. Let me show you what I mean, via a simple example (that restricts attention to steady-states).

There is a cyclical variable, labeled y. This denotes the output produced by a job-worker pair. I assume a "fair share" bargaining rule that divides this output into wage and profit components. A firm's flow profit is given by the share ξy. The present value of this profit flow is denoted J(y). This value is procyclical; i.e., it will increase when the cyclical variable y increases.

If a firm wants to open a job vacancy, it must bear a cost κ. It is successful in finding an unemployed worker with probability xq(θ); where θ = v/u is the "labor market tightness" variable, and where q(.)=M(.)/v. If the new hire starts work next period, the expected present value of posting a vacancy is xq(θ)βJ(y). The following zero-profit condition determines the equilibrium labor market tightness:

[3] xq(θ)βJ(y) = κ

Condition [3] determines θ(y,x). It is easy to show that θ is increasing in the "cyclical" variable y and the "structural" variable x.

Finally, there is a stock-flow equation that determines the equilibrium unemployment rate: u = σ / (σ + xp(θ)); where σ is an exogenous match separation parameter (job destruction rate).

I parameterize this simple model and compute the equilibrium vacancy-unemployment combinations under two scenarios (GAUSS code available on request). First, I vary the "cyclical" variable y 15% above and below its mean value, holding x fixed. Then, I hold y fixed at its mean value and vary the "structural" variable x 15% above and below its mean. And here is what I get:

In short, one reason why job openings may have declined is because it is generally more difficult for firms to find the right worker. Indeed, given how circumstances may have changed since the recession, firms may not--as of yet--even know what type of skill set constitutes the best hiring investment. Until this uncertainty in the match-making process sorts itself out, it may make sense to recruit less intensively.

David,

ReplyDeleteYour data is aggregated across industries and geography, right?

I think there could be some insights from disaggregation along both of those angles, but I don't think JOLTS data is available in geographic disaggregation.

But consider the construction industry versus the health care industry. If those industries have different Beveridge curve behavior, that would helps us to narrow down the possible causes of the aggregate Beveridge curve behavior, no?

Interesting post! What about this as a possible explanation:

ReplyDelete1) Layoffs have generally ceased for some time now.

2) Businesses are expecting the economy to improve and orders to pick up in the near future.

3) There is an unprecedented amount of talented people out there looking for work.

4) Managers are seeing a lot of people that are nearing retirement and are aware of what positions they will need to fill.

5) HR departments are *passively* recruiting for those positions. IOW, they are hoarding resumes.

6) When orders do pick up, they've got the pick of the crop.

Just a thought or two.

Unemployment rate depends on layoffs as well as hirings. In 2007, layoffs were around 300,000 per week. Now they are over 400,000 per week. Do you think it would require more job openings to cause a decrease in unemployment if the rate of layoffs were higher?

ReplyDeleteIn our current economy, this graph suggests that no matter what happens to the JOLTS, unemployment has stayed about the same. Why is unemployment not responding to increase in JOLTS?

Do more people move from "Discouraged, not looking for work" to "Unemployed, applying for jobs" when new jobs are posted?

Prof J: Yes, this is aggregate data. Disaggregated data is what we need. I'm not sure, however, whether standard "sector" definitions are fine enough. I'd like to get right down to the individual level, and this might be available in the PSID...am looking into it.

ReplyDeleteDoc: Are you proposing these as explanations for recent BC behavior?

Anonymous: In answer to your first question, yes. An increase in the job destruction rate has (I think) qualitatively the same effect as a decrease in the match efficiency parameter in the model above. In answer to your last question, there is some evidence to suggest that the transition from out-of-the-labor-force to unemployment picks up as the economy recovers.

Why don't you get out of the ivory tower, turn off the commputer, and do a full survey of EVERY job opening and EVERY job seeker.

ReplyDeleteThere are tens of thousands of economists. Crowd swarm this doing field research the way they in sciences like biology.

Or is it just too much fun running numbers and plotting graphs on a computer?

David: Yes, I suppose I am seeing my "explanations" as an alternative-perhaps a behavioral explanation. Whether that lends support to your hunches or not, I'm not entirely sure! First off, I'm not an economist-declared econ major for short while, but went off into mfg. instead, but I gravitate towards econ/finance blogs.

ReplyDeleteAnyhow, I'm basing the explanation on recent anecdotal stuff-on the experience of becoming unemployed in 2008 and then re-employed in 2009. While looking for work I carefully went through most of the positions open in my State's Career website, getting a feel for what people were looking for. One of the things that seemed to strike me was that, before things got really ugly (before mid-2008), openings seemed less selective, requirements less exhaustive, while the number of openings seemed pretty reasonable. When things got ugly(late 2008/early 2009) the *number* of openings plummeted, while the requirements seemed to shoot up. When the general economy started to recover and the panic started diminishing, the openings definitely spiked up, but the requirements also seemed to be even more unrealistic for the positions.

Employers seemed to be looking for that "perfect match" they never could find. They also seemed to want ready-made, turnkey experienced people, and nobody wanted to waste any time training anybody. Employers seem to be short staffed and people overworked right now, IMO, so there isn't time for training-it takes away too much valuable time from other, more experienced workers.

It seems from my experience that HR people and managers (since the *last* recession), just are not putting much effort into getting people lined up to replace the high-experience folks who were nearing retirement and retiring. Well... I think they are starting to wake up to this problem and people ARE starting to retire and leave and it's one of those fire drills for them to get a replacement. As always, they want to get the most experienced person they can for the least compensation and combined with all the job networking sites on the web, they are compiling a dbase of all the candidates they can. Even if they don't need somebody *right now*, they know they may need somebody on short notice in the near future.

It just seems to make sense that they are waiting... for their orders to pick up, someone to retire, and they want to be ready to pull the trigger and get the best candidate for the position. So, I see it as a combination of current lack of demand (not pulling the trigger), but they worry about needing to fill some positions on short notice and wanting people ready to hit the ground running when they hire. So they are putting out a lot of feelers.. just in case?

Anonymous @12:12PM: If I understand you correctly, you are suggesting that the profession would do well to devote more resources to measurement. I would agree with this sentiment. Thank you for this contribution.

ReplyDeleteDoc: A lot of the anecdotal evidence you cite seems consistent with my own experience of being an unemployed construction worker (in the 81-82 recession). There is no question that hiring standards fall during a boom and rise during a bust. I saw this first hand. See also my post here:

http://andolfatto.blogspot.com/2010/10/old-dogs-new-tricks.html

I believe Davis and Haltiwanger (and perhaps someone else) argue that even when firms post job openings these days, they aren't necessarily eager to fill them (unless, I suppose, some unusually qualified candidate comes along). Basically, firms can afford to wait, for the time-being. Anyway, thanks for sharing...it was interesting.

David,

ReplyDeletethe thing I'm sort of struggling with here is the question of why a shortfall of demand can't be the negative shock to the efficiency of the matching function?

Along the same lines, thinking back to your posts on theory before measurement of unemployment and the labour turnover data you were willing, correctly if I'm wrong, to assume that even though there was a search friction that prevented workers from knowing where to find the right job they would have a lot of information about whether or not a(good enough) job was available at all. (I recall you asking things like "if there aren't any jobs then why does anyone search?").

Again correct me if I'm wrong but while in principle one can have information on aggregates but still have the seach friction that seems a bit of a special assumption and possibly not that realistic. Seems to me the same information problems that require search would prevent workers knowing if there are good mathces available or not.

In the same sense, if firms are shifting resources away from recruiting, that is they post job openings but are not willing to devote as much labour and capital to seeing them filled quickly, then this would show up as decline in the matching function efficiency.

Further, a fall in demand could well be driving a fall in the output produced by a job-worker pair (particularly for service type jobs).

I guess I'm asking if everything your arguing (not just this post) really is inconsistent with the idea of demand simply being too low?

Adam P:

ReplyDeleteWith respect to your first question, it is not clear to me whether it is addressed to the model I wrote down, or to the actual economy (or some other model economy).

In terms of the model I wrote down, I guess the answer is pretty clear. (The demand shock variable does not affect match efficiency by assumption).

Actually, as I re-read your 4th paragraph, I see that perhaps you are asking a measurement question. I agree with you that an endogenous decline in search intensity, driven by a negative demand shock, will show up as a decline in match efficiency (if measurements are not corrected for variable search intensity). Indeed, I say as much here:

It's important not to get too carried away with this result. In particular, we have all the usual measurement problems to contend with when constructing TFP measures. For example, much or perhaps even most of the decline in measured TFP may be the consequence of (unmeasured) reductions in search intensity.

To answer your last question: I don't know! But even if it is purely a demand story, we need to explain why demand remains persistently low. (It is not a matter of demand "simply" being too low). Personally, I think it is more than this; that is, that it takes time to pick up the pieces following a major financial shock. And that current demand conditions reflect, at least in part, the slow structural readjustments that need to take place. But this is largely just an opinion.

I have no doubt that some exogenous impulse to demand (eg, govt spending) might stimulate economic activity. But what sort of activities would be stimulated? Are they the wise investments we need? Or do they simply constitute "busy work" that will, no doubt, show up the NIPA accounts as increased GDP -- but at the end of the day may simply constitute squandered resources?

Sorry, yes it was measurement question the whole thing. The thing I'm struggling with here is if we can ever really tell the difference.

ReplyDeleteIt's like any TFP measurements, what we measure is rarely what we mean to. Basically an identification issue, the assumption that the demand shock variable doesn't affect match efficiency at all is an identifying assumption.

"But even if it is purely a demand story, we need to explain why demand remains persistently low. (It is not a matter of demand "simply" being too low). "

ReplyDeleteHere's my take: http://canucksanonymous.blogspot.com/2010/07/why-we-keep-having-bubbles.html

basically it's not that demand is too low, it's that the level of demand required for full employment is too high.

But that would still mean demand is "deficient"...

Problem is, while I persist in believing the problem is deficient demand I don't entirely believe my own story, I can't really explain why I believe this. It would help if I could understand why you don't believe it but I'm not getting very far there either.

Adam P: OK, if was simply the measurement issue, then I agree; it is problematic. We need better measurements.

ReplyDeleteI have read your "Why we keep having bubbles" post. We seem to have two very different perspectives on the matter. I have two related posts on the subject myself:

http://andolfatto.blogspot.com/2010/08/global-imbalances-good-for-world.html

http://andolfatto.blogspot.com/2010/08/asset-shortages-and-price-bubbles-new.html

This is not to discount your own view entirely. There may be an element of truth to it, though I dislike the populist sentiment of blaming China for all our woes.

"I dislike the populist sentiment of blaming China for all our woes. "

ReplyDeleteI didn't actually think I was doing that, the point of the post was to do two things, defend the fed and argue that we need some sort of inflation to reach full employment.

Point one was aimed at those that blame the fed for somehow causing the housing bubble by keeping rates too low for too long after the 2000 recession and 9/11. Everyone assumes that had the the fed tightened to avoid the housing bubble then we'd have still had the same 4% unemployment but with now bubble or crisis. I claim we'd have simply had our high unemployment sooner.

The other point is that somehwat higher inflation, say 3-4%, would be a small price to pay if it got us substantially more employment and I tend to think it might.

That said, the fact that China sends us all this output and loans us the money to buy it at very low interest is not a practice we should want to discourage nor did I argue that we should discourage it. I made clear that the trade is a good thing for us, didn't I?

Now I do think the Chinese government is bad but I don't think this because of anything they're doing to us, I like that they send us stuff at what amounts to a massive discount. I don't like them because I don't believe they treat their own people well.

Adam:

ReplyDeleteWell, I guess I was misled a bit by your openinig statement:

The point of this post is to argue that, despite what we may naturally think, the reason that our economy is in such a mess can be traced essentially to one source: China.

But let's set that aside for now and focus on the substance of your argument. Let's see if I understand the gist of it.

China wants U.S. paper and imports this paper in exchange for cheap Chinese products. The Americans employed in the sectors that compete with these Chinese products would, in an ideal world, be reallocated to sectors that produce American goods destined for China. But China does not want these goods; they want our paper. And so the American worker is unemployed.

Here's the part where I lose you:

you could say that our problem is that in order to maintain full employment we have to spend all of the savings that China sends us and this requires more spending on C, I and G than we have income Y.

We have to "spend" all the "savings" China sends us? They send us toys in exchange for paper. OK, but the point is, I guess, that Americans need to spend more on domestically produced output, if domestic employment is to increase.

And the way this is done is either through asset price bubbles (a temporary fix), or by creating some inflation. Something like this...though I am having a hard time crystalizing the logic.

yes, the argument is that effectively the US needs to have enough demand for goods of whatever type to make some use of the potential output of our economy and what China sends us.

ReplyDeleteThis entails something that looks like overspending somewhere in the economy.

As for the phrasing, seems to me when I buy a bond from GE or another company I'm sending them my savings to spend. How would it be different if I also happened to work in the industry that produces what they spent my savings on?

The net effect is that case would be that I give GE my savings in the form of my output. Since I've forgone the chance to turn my output into something I want to consume today (or conumed it myself if it's that sort of output) and instead accepted a note that is a claim on consumption in the future it is savings from my point of view, and GE is spending it for me.

BTW, you're of course absolutely right about the opening paragraph. I must have just finished reading some Krugman when I wrote it:)

ReplyDeleteAnd one further comment on this: "The net effect is that case would be that I give GE my savings in the form of my output."

ReplyDeleteIn a frictionless model or monetary economy this is always in some sense equivalent to what happens. The following scenarios are perfectly equivalent:

1) I give GE my output in exchange for their paper, they trade my output for what they want.

2) I trade my output for what GE wants and then trade it to them for the bond.

3) I trade my output for money, give the money to GE in exchange for the bond and then GE trades the money for what they want.

I used phrasing from case 1 in the post.

Adam:

ReplyDeleteOK then. Um, a question though. China wants US paper, not US goods. If they wanted US goods, US workers laid off in sectors competing with cheap Chinese exports would be re-employed in sectors producing relatively cheap US goods that the Chinese did want. OK so far?

But, the Chinese (for whatever reason) do not want US goods; they want US paper. And so, I said above, the US worker is unemployed.

But that was just an assertion. Why is the unemployed worker not re-employed producing goods that Americans want? To hell with sending these goods to China (we are sending them toilet paper, which is what they want anyway).

Your argument is that, somehow, there is not enough domestic demand for this potential output. But that's kind of a hazy claim (which is not to say that it isn't true). In the model I sent you (Global Imabalances: Good for the World), this does not happen. Global imbalances are a market-clearing phenomenon and a win-win scenario.

"Why is the unemployed worker not re-employed producing goods that Americans want? "

ReplyDeleteWell I don't know, one of the reasons I don't entirely believe my own story (and why I'm pestering you to talk to me about it, no point in talking to someone who'd just accept deficient demand at face value!)

Two possibilities:

1) People don't want to take on that much debt. For the nation's populace to consistently spend more than their income they need to be taking on more and more debt, as they were in the bubble.

Once you endogenize leverage constraints instead of assuming them, limited commitment say, then you see immediately there must be costs of default, to the defaulter that is. Otherwise we'd see more default and less debt. The point here is that in general you might expect that endogenous leverage constraints don't just work through lenders, borrowers also don't want to exceed a certain debt limit (except if you just assume they do ala Krugman/Eggertson I guess).

Maybe people are refusing to borrow that much and you need an asset bubble to induce them to do it. It's this point that inflation seems an effective solution to.

After all, everyone likes to say "deleveraging shock!!!! monetary policy can't help". Why was that much leverage desirable a month ago? Nobody ever asks this.

2) Lack of product variety. Maybe we need to invent something new for them to produce where they're not competing with cheaper Chinese labour. Anything that is intensive in low skilled labour and can be produced in China will be produced there.

Possibly. To this list we might add Shimer and Hall's contention that real wages are sticky, which depresses the recruiting effort that might otherwise have sought out and employed these workers.

ReplyDeleteBtw, on your "nobody ever asks this (question about leverage)," I think that Gary Gorton speaks to this point; see his interview (available on Steve Williamson's blog).

"where σ is an exogenous match separation parameter"

ReplyDeleteDoesn't this "parameter" increase sharply in a recession?

If firms have the ability to layoff workers when they don't feel they need them (which all these models prohibit), wouldn't they be also laying off fewer workers when matching TFP falls? Workers are more valuable when they're harder to find!

REVOLUZA Anmeldung. Revoluza vereint erstmalig 3 Industrien zu einem eingizartigen Business! Adult Entertainment, Network Marketing und das Internet. visit here : Revoluza Network

ReplyDeleteCleanTech Patent Agent

ReplyDelete