Since I happen to have handy some regional data on the help-wanted index (HWI) for the U.S., I thought it might be interesting to see whether U.S. vacancy and unemployment dynamics in a cross-section display any interesting patterns. (I would like to thank Kyle Herkenhoff for suggesting this exercise to me).

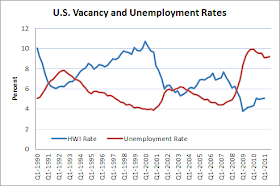

The regional HWI data is from the Conference Board. I explain here how the data was corrected for the recent substitution from print to electronic media in job advertising activities. That data was constructed for 36 U.S. cities. I construct a "vacancy rate" measure by dividing the HWI by the labor force and normalizing to 10 in 1990:1. Here is what the aggregate data looks like:

Labor economists sometimes like to gauge labor market conditions by constructing a "labor market tightness" variable--the ratio of vacancies to unemployment, or the v/u ratio. The v/u ratio plays a prominent role equilibrium unemployment theory; see Diamond, Mortensen and Pissarides. As the following diagram shows, labor-market-tightness is highly procyclical.

Regional Patterns

The following diagram plots the unemployment rates for 36 metropolitan areas in the U.S. The solid black line is a population-weighted average (it corresponds to the national unemployment rate).

The figure shows that there is significant disparity in regional unemployment rates at all points in the business cycle. As the U.S. economy emerged from the recession in the early 1990s, regional variation in unemployment rates seems to have declined for the rest of that decade. Nothing much changed until the most recent recession, where we see a dramatic increase in both the average unemployment rate and its in its dispersion across regions.

Next, let's take a look at regional "vacancy rates" (the city-based HWI divided by regional labor force).

First, what accounts for the dispersion? In a basic Mortensen-Pissarides labor market search model, extended to incorporate regions, I think that the labor-market-tightness variable is likely to equate across regions (at least, allowing for factor mobility). Regional differences in tax rates, etc., might account for some of the disparity. But the measured disparity is huge.

Second, what accounts for the cyclical properties of the dispersion? Is it simply the case that some regions are populated by industries that are more cyclically sensitive to aggregate shocks? Or is it the case that the shocks themselves are concentrated in certain regions, with the effects propagating to other regions of the country?

If anyone would like to see this data plotted in a different way, or see some statistics reported, feel free to let me know. (Thanks to Constanza Liborio for preparing these graphs.)

Some areas rely more on online ads as far as posted vacancies go? That is, unless your index account for those too, which I think it doesn't.

ReplyDeleteDavid,

ReplyDeleteSome factors that can create such a dispersion:

1) Different industries display different correlations to the business cycle; to the extent more/less cyclical industries concentrate by region, you could see such a dispersion;

For example, housing construction boomed in some regions, but not in others. Therefore, the places where it boomed and crashed will show more cyclicality than other places.

You'll have to check on that - I can't tell which cities belong to which lines in the graph.

2) One factor that may be limiting factor mobility right now is home ownership. To the extent more people own a house rather than rent their mobility is much more limited. I don't know how big of a factor that is.

3) Another factor - there are state by state differences in the level of unemployment insurance payments. If the UI payment relative to expected wages, that can cause some dispersion because of an effect on the unemployment rate.

4) Again, a little hard to tell, but it seems the vacancy rates have larger dispersion and less cyclicality than the unemployment rate. I have to think about this more, but the answer might be in there some where.

Got to work on a paper for FMA submission, but this is a pretty interesting finding!

Prof J,

ReplyDeleteThe idea of regional real estate booms contributing to this dispersion is almost surely true. Planned to delve into that.

I'm not sure about homeownership restricting labor mobility. The studies I've heard about suggest that this is not quantitatively very important. Still, I guess we should not dismiss it as out of hand quite yet.

David,

ReplyDeleteYou say: "Is it simply the case that some regions are populated by industries that are more cyclically sensitive to aggregate shocks?"

I think you are onto something there. I've been chatting with one of the economists at my school, and he's noted that a few states lead the business cycle and a few states lag it. The states that lead the business cycle appear to have a greater portion of state output generated by industries that are farther from the consumer stage of output. For example, more mining/basic materials production.

The reason higher-order industries are more cyclical is implied by the Austrian business cycle theory, but I think (IIRC) that it is also the implication from the RBC papers where there are two uses of output - intermediate goods and consumer goods. I don't have time to look that up now, so I hope I'm not being terribly unclear.

I haven't seen any work on this issue specifically, but I think it can explain some of the cyclicality and dispersion. Again, I don't know the explanatory power, but it would be worth delving into.

Also,

ReplyDelete"I'm not sure about homeownership restricting labor mobility. The studies I've heard about suggest that this is not quantitatively very important. Still, I guess we should not dismiss it as out of hand quite yet."

It probably isn't a big deal in the aggregate. Across certain industries, though, you might see some action. Evidence against this explanation is that home ownership rates did not increase by very much (can't find data right now, but I think it recently was only 2-3% above the long-run average).

But, you know me, I think that one explanation for all industries/regions is sort of suspect anyway. I'm a micro guy at heart!

Perhaps the affect that home ownership may or may not have on labour mobility isn't picked up by home ownership rates but by some other measure. Something along the lines of excess supply, fall in prices or perhaps prices in comparison to rental costs (as some measure of return).

ReplyDeleteWhile these are surely not the best examples, they hopefully illustrate what I am trying to get at. That people are more stuck now in their homes because it is harder to sell (without taking a big loss at least). This would be especially pertinent to areas hit hardest which are probably pro cyclical.

So it's not that variation in home ownership rates has some constant effect on labour mobility, but rather variation in the effect of home ownership on labour mobility coming in through the housing market.

--or not, I can't really back this up.

"The studies I've heard about suggest that this is not quantitatively very important."

ReplyDeleteThere was a private sector study earlier in the week that came to the same conclusion by looking at negative equity vs. out-migration.

[Anon212]

This post and the comments are pathetic,especially the comment by someone about the Austrian school and "older" businesses. Food and automobiles are the firms of the future, not the past. The personal computer is a mature industry, now more than 30 years old. Talk about Kahneman blindness and bias.

ReplyDelete1. You work in St. Louis, are employed by the St. Louis fed. How about some local insight?

2. Your Kahneman blindness and bias is shown when, probably a Bullard's instruction, you inserted the word taxes.

3. The explanation is the private debt bubble, which has strong regional variance and which drove unemployment. Bloomberg covered the matter in this newstory. How Household Debt Contributes to Unemployment: Mian and Sufi

http://www.bloomberg.com/news/2011-11-17/how-household-debt-contributes-to-job-cuts-commentary-by-mian-and-sufi.html

I simple web search will turn up Mian and Sufi's work. Their Nov. 2011 paper is excellent, but does not give info for specific cities. (W/O city specific data, how can we make local judgements?).

John D,

ReplyDeleteThank you for sending me that Bloomberg article. I certainly do think that "debt overhang" for consumers has been an important factor. I am not sure if it is the most important factor, however. The big hit was really in investment; and residential investment, in particular, continues to lag.

Having said that, I was having my RA investigate the regional covariation between home prices and labor market tightness. I will try to get to Mian and Sufi's work, time permitting.

Tell me in detail whats reason to this type The regional dispersion vacancy and unemployment rates come in job sector.

ReplyDeletegovernment interpreter jobsweek