The backdrop for the paper is, of course, the recent financial crisis and associated recession. The level of GDP has essentially recovered its pre-recession level, while employment appears not to have recovered at all--these joint dynamics are referred to as a "jobless recovery."

The hypothesis Shimer puts forth is this: [1] there was a shock (or shocks) that led to an evaporation in the value of the economy's capital stock; and [2] real wage growth is "sticky" in the sense that it appears insensitive to macro shocks.

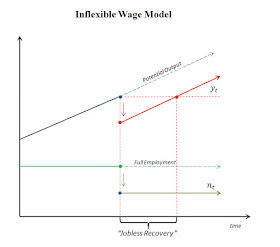

The type of evidence that lends some support for this latter hypothesis is displayed in the following diagram (also used by Bob Hall in his talk).

To begin, consider a standard neoclassical growth model and let us consider a point on along the balanced growth path, where output and wages are growing, and employment (per capita) remains fixed over time.

Now, imagine that we shock the economy by evaporating some fraction of its capital stock. The subsequent transition dynamics are familiar to macroeconomic theorists and there is no need to describe them in detail here. The important thing is that real wages initially fall (since labor productivity falls and wages are flexible) and that the economy eventually returns to its balanced growth path.

Next, let us repeat the experiment, but assuming instead that real wages continue to grow along their balanced growth path (that is, the real wage does not respond to the shock). What do the subsequent transition dynamics look like? My own expectation was that the economy would once again return to its balanced growth path, but that the period of transition would be extended owing to the assumed rigidity in the real wage. Everyone I quizzed about this had the same expectation.

Surprisingly, to me at least, this intuition turns out to be completely wrong! Output and employment drops on impact, but then output stays along its new balanced growth path, with employment remaining below full employment forever; see the following diagram.

An OLG Model

People live for 2 periods and they value consumption only in the last period of life; write the utility function of a person born at date t as Ut = ct+1. This simplifying assumption implies that the young save all their income.

The young are each endowed with one unit of time, which they supply inelastically to the labor market. Let N denote the population of young workers; and assume that N remains constant over time. Let wt denote the real wage at date t.

The old are in possession of the economy's capital stock Kt. The old hire young labor at the prevailing wage, produce output, and then consume the profit (the return on capital). Capital depreciates fully after it is used in production.

There is a standard neoclassical production technology Y = F(K,N) satisfying Y = f(k)N, where k = K/N is the capital labor ratio. Let F be Cobb-Douglas and let 0 < α < 1 denote capital's share of output. Then we have f '(k)k = αf(k).

Now, the demand for labor satisfies: wt = FN(Kt,Ntd) and the supply of labor satisfies Nts = N. In a competitive equilibrium, the real wage must satisfy:

[1] wt = FN(Kt,N) = (1 - α)f(kt); where kt = Kt/N.

In what follows, I set the exogenous growth rate to zero, since doing so is not important for explaining the main result. Now, as the young save all their earnings, it follows that the next period capital stock (per young person) is given by:

[2] kt+1 = (1 - α)f(kt)

In other words, the dynamics are equivalent to the standard Solow model we teach to undergrads. The nondegenerate steady state capital-labor ratio is characterized by:

[3] k* = (1-α)f(k*) [Note that k* = w* ]

Alright then. Begin at a point on the balanced growth path (here, a steady state with zero growth) and evaporate some capital, so that K0 < K*. This is a crude way to model the impact effect of a financial crisis. The transition dynamics should be familiar to any student of the Solow model; in particular, see [2]. In a decentralized version of this model, employment remains fixed at N, but the real wage (and the real wage bill) initially declines, before transitioning back to their original steady state values.

O.K., now let's repeat this experiment, but this time under the assumption that the real wage remains fixed at its initial steady-state value, wt = w* for all t. In this case, the level of employment N0 < N is determined the demand for labor; i.e.,

[4] w* = FN(K0,N0) = (1 - α)f(k*) = k*

Condition [4] implies that the capital-labor ratio remains unchanged; i.e., K0/N0 = k*. That is, the demand for labor declines in proportion to the decline in the value of capital. Since the real wage is fixed, this also implies that the aggregate wage bill declines in the same proportion. And since the wage bill here constitutes the saving that finances new capital, we have:

[5] K1 = w*N0 = K0 [since N0 = K0/k* and k* = w* ]

In other words, the capital stock remains forever fixed at K0 < K* and the level of employment remains forever fixed at N0 < N.

This is a permanent depression! If we extend the model to allow for exogenous growth, the level of employment remains depressed, but the level of output grows and eventually recovers its original level (this is the jobless recovery phase). However, the level of output remains forever below its "potential." Interesting.

Labor Market Search

One of the drawbacks of the model above is that both firms and workers stand to gain by negotiating the real wage downward following the shock. There is nothing in this model that prevents agents from exploiting these gains from trade, so ruling it out exogenously seems wrong (even if it is deemed realistic).

To address this shortcoming, Shimer extends the neoclassical model with the competitive labor market replaced by a search market, with bilateral meetings and negotiations. One of the nice things about the search specification is that the real wage may remain fixed in an equilibrium (if the shock is not too large). In other words, there need not be any inefficiency associated with a fixed wage at the individual level (though, it may induce an inefficiency at the aggregate level).

Shimer shows that the search model with rigid real wages generates dynamics that closely resemble those generated by a standard neoclassical model with rigid real wages. There appears to be an added force at work in the search model though. In particular, the combination of the negative shock and fixed real wage (along its balanced growth path) serves, in a way, to redistribute bargaining power from firms to workers. This is bad news for job creation, because the returns to investing in recruiting activities is now diminished, leading to a prolonged decline in employment. Sounds familiar.

In my view, this is an argument that deserves to be taken seriously. How seriously depends on how seriously one takes the "rigid real wage" hypothesis. Christopher Pissarides has criticized the assumption on the grounds that, in reality, real wages for new hires (or job changers) appear to be quite flexible relative to workers who remain employed. And, as Pissarides points out, the wages of incumbent workers do not factor into hiring decisions in a search model (assuming that the firm is not credit constrained). The key price as far as recruiting is concerned is the expected wage demands of future employees; and these appear to be relatively flexible.

This is all very interesting stuff. Almost makes me want to work in the area again!

P.S. The policy implications also turn out to be very interesting. Despite the "Keynesian" sticky wage property of these models, fiscal stimulus in the form of an increase in government purchases has the effect of crowding out capital investment, with no effect on employment. On the other hand, fiscal policies that subsidize business sector hiring (like a cut in the payroll tax) appear to be effective.

Although nobody is actually commenting on this post, I just wanted to tell you I found it really interesting and your simplification actually helped a lot.

ReplyDeleteDavid,

ReplyDeleteA very interesting result. I have no criticism of it further than the limitations you mention yourself.

A general point, I do have. Talking with the economists in my department (we do graduate managerial (read: game theory) Econ in the B-school), we sort of got around the other day to thinking that we could learn a lot by finding ways, within models, to induce crashes without relying on shocks. Hall, for example, is doing this with his financial wedges (I'm sure you are aware).

I can see the same sort of thinking going on here - how can we crash the economy within the model?

Right now I'm working on a small neoclassical model that looks at what happens when you have different tax rates on credit-offering corporations depending on the interest rate charged. It looks like you can induce intertemporal autarky for a large swath of the population.

I think there's much to be learned from this line of inquiry.

Citoyen: Hey, thanks! I wonder at times whether I'm just talking to myself... :)

ReplyDeleteProf J: I might be missing something here, but I'm not sure how to induce a crash without appealing to some shock (unless you have some deterministic cycle model in mind). Your paper sounds interesting; do you have a link to it (or can you send it to me)?

David,

ReplyDeleteI'm still working up the model. I'll put a link to it when I have it written up.

I have only read Hall's paper once, but I think his "financial wedge" is a type of shock. He has a baseline, and then causes the difference between borrowing and lending rates to get really large. I'm at SFA right now, so my mind is a little scattered.

David,

ReplyDeleteA clarification: In both Shimer's paper and your exposition using the neoclassical growth model, the trigger is a shock to physical capital (not the nominal value of it, as these models are "real"). By contrast, the experience of the most recent US recession (ie effects of the financial sector on the real economy) seem to be driven by a sharp decline in the "nominal" value of capital (I'm thinking, say, the value of the housing stock...).

Do you think this real versus nominal value decline in the capital stock is a relevant point?

Thanks

ps: Very nice OLG model exposition.

I don't totally get the concern over a "jobless recovery" in this recession.

ReplyDelete"The level of GDP has essentially recovered its pre-recession level, while employment appears not to have recovered at all"

Given that output is still far below trend in the USA, it makes sense that unemployment stays high. Productivity grows at 2% every year and population grows at about 1%, so real GDP needs to grow at 3% just to tread water. The last two quarters have had real GDP growth of 1.7% and 2.0%, so if anything, it's surprising that employment has held up as much as it has. One might predict that unemployment should have *risen* given the weak economic growth.

If you draw out a trend line of 2% growth in real GDP per capita from october 2007, US real gdp/pop is about 12% below trend. To get anywhere close to a reasonable trend line, we're going to have to grow RGDP much faster than 3% for a long time.

So for me, it's a "jobful" recovery

Anonymous: Thanks! Yes, the shock under consideration assumes that physical capital literally evaporates. This is clearly reduced form, so I can offer no excuse for it apart from the usual one. Shimer is well aware of this too. In fact, he devotes a large part of his conclusion to discussing the microfoundations that might deliver what in a one-sector model looks like capital evaporation. I would be interested to see people work on this.

ReplyDeleteG: You seem to be saying that since GDP is currently below potential, it's not surprising that unemployment is high. Shimer, of course, is interested in explaining why GDP appears to remain below potential.

"One of the nice things about the search specification is that the real wage may remain fixed in an equilibrium (if the shock is not too large). In other words, there need not be any inefficiency associated with a fixed wage at the individual level (though, it may induce an inefficiency at the aggregate level)."

ReplyDeleteI heard this argument before, and I still don't understand it. Either separation is inefficient (i.e. separation even at positive surplus), and then Barro's criticism is still in play -- search model or no search model. Or separation is efficient (i.e negative surplus), and then I can't see what the innovation is.

pontus: You need to distinguish between what is efficient at the match level and what is efficient at the social level. If there are externalities in the search process, then the match division rule may be efficient at the match level, but not at the social level. In particular, equilibrium search effort (which depends on the match rule) may be either too high or too low. This is related to the so-called Hosios condition; see also Dale Mortensen's 1982 AER paper on Mating, Racing, and Related Games.

ReplyDeleteThanks Davis, I understand this point, but what I fail to see is how wage stickiness fits in here. As you say, Hosio's condition, with related externalities, is present without any stickiness. What matters is if surplus goes to zero or not, no wage-flexibility in the world can save the match, nor can any stickiness avoid Barro's criticism if surplus falls below zero ...

ReplyDeletePontus: OK, so I must have misunderstood you. Let me see if I can clear things up (in my own head, if not yours!)

ReplyDelete[1] First off, we assume that matching at the bilateral level is efficient; a match with positive surplus will not break up (at least not endogenously).

[2] Number [1] may require some wage flexibility to keep the match operating in the face of some shocks. But in general, there is a range of indeterminancy; the wage simply serves to split the surplus in some manner. So, for "small" enough shocks, it is fine if the wage remains rigid. Of course, it is also fine if the wage moves around, as it would in a Nash bargain.

Are you fine with this so far?

[3] So if both rigid wages and the Nash bargain are fine, what is the point of the rigid wage? The rigid wage makes the firm's share of the surplus more sensitive to shocks. Think of the wage bill as representing debt, so that the firm is the residual claimant (equity). The value of equity fluctuates far more than the value of debt.

[4] Because of [3], recruiting intensity fluctuates a lot more under rigid wages; hence, employment fluctuates a lot more.

Does this help? I hope that I have understood what you are asking.

David, I'm with you all the way (in fact, isn't this the essence of Bob Hall's story?). But I thought that Shimer went further and considered endogenous separations. If he doesn't, then I completely understand and my previous comments were misguided. If he does, I would still maintain that separations has to be inefficient (for the partnership) in order to avoid Barro's criticism, and that sticky wages do nothing to avoid this.

ReplyDeleteBy the way, I really appreciate your tone and that you take the time to answer my, sometimes silly, questions.

Pontus: Ah, I see where you're coming from now! No, Shimer assumes a constant and exogenous separation rate. And yes, the story I was telling is Hall's. I do not think your questions were silly. I was just having a hard time understanding exactly what you were saying. I have to go baste a turkey now...Happy Thanksgiving!

ReplyDeleteHappy thanksgiving, and thanks for your replies!

ReplyDelete