The Phillips curve can mean one of two conceptually distinct things (which are sometimes confused). First, the Phillips curve may simply refer to a statistical property of the data--for example, what is the correlation between inflation and unemployment (either unconditionally, or controlling for a set of factors)? Second, the Phillips curve may refer to a theoretical mechanism--why does inflation and unemployment exhibit the statistical properties it does?

The presumption among many is that statistical Phillips curves tend to be negatively sloped, suggesting a trade-off between inflation and unemployment. A standard theoretical interpretation of this negative relationship is that a high level of unemployment means that aggregate demand is low, so that firms feel less inclined to increase the price of their goods and services. Conversely, when unemployment is low, aggregate demand is high, allowing firms to raise their prices at a faster rate.

The problem is that statistical Phillips curves are not always negatively sloped. In fact, sometimes they appear to be positively sloped. Over long periods of time, the data looks like a shotgun blast (i.e., zero correlation). In a recent empirical study, however, Blanchard (2016) claims that the Phillips curve is alive (though perhaps not so well) in the U.S. data. Among other things, he reports that:

Whatever the explanation, it will have to account for what I think is an interesting asymmetry in the statistical Phillips curve. In particular, the U.S. Phillips curve appears to be negatively sloped when unemployment is rising (as in a recession) and is either flat or even positively sloped when unemployment is falling (as in a recovery).

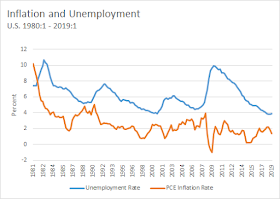

In what follows, I measure inflation as the monthly year-over-year change in the PCE, averaged at the quarterly frequency. The unemployment rate is the quarterly civilian unemployment rate. I look at U.S. data 1980:1 - 2019:1. Here's what the data looks like.

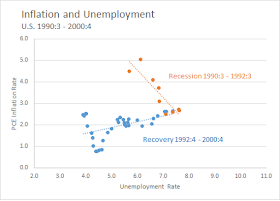

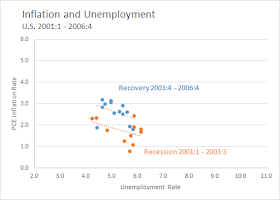

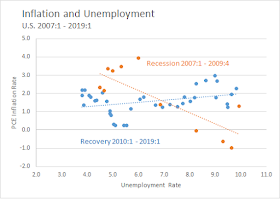

I define "recession" as quarters in which the unemployment rate is trending up and "recovery" as quarters in which the unemployment rate is trending down. I divide the sample above into four recession-recovery subsamples. In effect, I plot the Phillips curve conditional on whether the unemployment rate is rising or falling. A full analysis should also control for monetary policy and inflation expectations, but I leave that for another day. Here is what I find.

Episode 1. Recession 1981:1 - 1982:4 and Recovery 1983:1 - 1990:2

Episode 2. Recession 1990:3 - 1992:3 and Recovery 1992:4 - 2000:4

Episode 3. Recession 2001:1 - 2003:3 and Recovery 2003:4 - 2006:4

Episode 4. Recession 2007:1 - 2009:4 and Recovery 2010:1 - 2019:1

So it seems that the Phillips curve is alive and well -- but only in recessionary periods. Recessions in the United States tend to be sharp and short-lived. The unemployment rate displays a well-known cyclical asymmetry (something that labor-market search theory accounts for in a natural way; e.g., see here). Whatever it is that drives the unemployment rate sharply higher seems to release a disinflationary force that is not immediately mitigated by monetary and fiscal policy.

At the same time, it seems that the Phillips curve is dead -- at least, once the dust has settled and the economy enters into its typical recovery and expansion phase. (Or does the Phillips curve only appear flat because monetary policy tends to tighten policy over the recovery phase?)

Policy Implications?

What does this imply about the conduct of monetary policy? Well, we have to be careful, of course. But to my eye, the evidence above suggests that the Fed need not worry about letting the unemployment rate decline as far as it wants during a period of economic expansion. The specter of a sharp spike in future inflation because unemployment is too low seems nowhere evident in the data (see also Bullard 2017). In addition, we do not know where the so-called "natural" rate of unemployment resides at any given point in time, assuming that such an object even exists.

In the present environment, I think one might even be inclined to let inflation fluctuate below the target rate--in other words, treat the target rate as a soft ceiling when the economy is expanding. Trying to induce inflation higher during an expansion phase seems strange (imprudent?) to me for a couple of reasons.

First, what is the point of purposely taking an action that could be construed as making the cost-of-living grow more rapidly over time? How is such an action to be justified, apart from fulfilling an apparent desire on the part of a small number of technocrats to maintain "credibility" of the "symmetric" inflation target? There may be ways to justify persistent inflation overshooting following a period of persistent undershooting (e.g., if the goal is price-level targeting). But the arguments I've heard made in this regard are probably too subtle to communicate effectively and persuasively. If so, then why not just let inflation fluctuate between 0-2%. It's not like we can measure it with precision in any case (a point former Vice Chair Stan Fischer was fond of repeating).

Second, modern day central banks were built for the purpose of keeping a lid on inflation--they were not built to promote it. The present projected trajectory of deficit-spending will almost surely, sooner or later (Japan notwithstanding), generate inflationary pressure. (If it doesn't, then please just keep cutting taxes and increasing spending.) So again, it seems that the Fed (and the U.S. economy) might be better served by viewing 2% inflation as a soft ceiling--something to defend only in the event that inflation begins to wander significantly and persistently away from 2% (or whatever number one has in mind) in normal times. Let the fiscal authority have the fiscal space it wants/needs as long as inflation remains low.

Recessions, when they hit, tend to appear suddenly and unpredictably. Forecasting the precise date of a recession is a mug's game. Estimating recession probabilities seems more art than science. Perhaps the best that monetary policy can do is to be prepared to act quickly and decisively when the unemployment rate starts rising rapidly. If recent history is a guide, a sharp recession is likely to release a strong disinflationary impulse (related theory paper). In the old days, we might have labeled this a "money demand shock." Today, it is more likely to be described as a "flight to safety shock"--i.e., the safety of U.S. dollars and Treasury securities. I don't think it's particularly helpful to say that high unemployment is causing low inflation--the direction of causality may working in the opposite direction (a high demand for money/debt is causing low inflation). But either way, the appropriate policy response likely entails an accommodating expansion in the supply of money/debt.

The presumption among many is that statistical Phillips curves tend to be negatively sloped, suggesting a trade-off between inflation and unemployment. A standard theoretical interpretation of this negative relationship is that a high level of unemployment means that aggregate demand is low, so that firms feel less inclined to increase the price of their goods and services. Conversely, when unemployment is low, aggregate demand is high, allowing firms to raise their prices at a faster rate.

The problem is that statistical Phillips curves are not always negatively sloped. In fact, sometimes they appear to be positively sloped. Over long periods of time, the data looks like a shotgun blast (i.e., zero correlation). In a recent empirical study, however, Blanchard (2016) claims that the Phillips curve is alive (though perhaps not so well) in the U.S. data. Among other things, he reports that:

- Low unemployment still pushes inflation up; high unemployment pushes it down.

- The slope of the Phillips curve, i.e., the effect of the unemployment rate on inflation given expected inflation, has substantially declined. But the decline dates back to the 1980s rather than to the crisis. There is no evidence of a further decline during the crisis.

Whatever the explanation, it will have to account for what I think is an interesting asymmetry in the statistical Phillips curve. In particular, the U.S. Phillips curve appears to be negatively sloped when unemployment is rising (as in a recession) and is either flat or even positively sloped when unemployment is falling (as in a recovery).

In what follows, I measure inflation as the monthly year-over-year change in the PCE, averaged at the quarterly frequency. The unemployment rate is the quarterly civilian unemployment rate. I look at U.S. data 1980:1 - 2019:1. Here's what the data looks like.

I define "recession" as quarters in which the unemployment rate is trending up and "recovery" as quarters in which the unemployment rate is trending down. I divide the sample above into four recession-recovery subsamples. In effect, I plot the Phillips curve conditional on whether the unemployment rate is rising or falling. A full analysis should also control for monetary policy and inflation expectations, but I leave that for another day. Here is what I find.

Episode 1. Recession 1981:1 - 1982:4 and Recovery 1983:1 - 1990:2

Episode 2. Recession 1990:3 - 1992:3 and Recovery 1992:4 - 2000:4

So it seems that the Phillips curve is alive and well -- but only in recessionary periods. Recessions in the United States tend to be sharp and short-lived. The unemployment rate displays a well-known cyclical asymmetry (something that labor-market search theory accounts for in a natural way; e.g., see here). Whatever it is that drives the unemployment rate sharply higher seems to release a disinflationary force that is not immediately mitigated by monetary and fiscal policy.

At the same time, it seems that the Phillips curve is dead -- at least, once the dust has settled and the economy enters into its typical recovery and expansion phase. (Or does the Phillips curve only appear flat because monetary policy tends to tighten policy over the recovery phase?)

Policy Implications?

What does this imply about the conduct of monetary policy? Well, we have to be careful, of course. But to my eye, the evidence above suggests that the Fed need not worry about letting the unemployment rate decline as far as it wants during a period of economic expansion. The specter of a sharp spike in future inflation because unemployment is too low seems nowhere evident in the data (see also Bullard 2017). In addition, we do not know where the so-called "natural" rate of unemployment resides at any given point in time, assuming that such an object even exists.

In the present environment, I think one might even be inclined to let inflation fluctuate below the target rate--in other words, treat the target rate as a soft ceiling when the economy is expanding. Trying to induce inflation higher during an expansion phase seems strange (imprudent?) to me for a couple of reasons.

First, what is the point of purposely taking an action that could be construed as making the cost-of-living grow more rapidly over time? How is such an action to be justified, apart from fulfilling an apparent desire on the part of a small number of technocrats to maintain "credibility" of the "symmetric" inflation target? There may be ways to justify persistent inflation overshooting following a period of persistent undershooting (e.g., if the goal is price-level targeting). But the arguments I've heard made in this regard are probably too subtle to communicate effectively and persuasively. If so, then why not just let inflation fluctuate between 0-2%. It's not like we can measure it with precision in any case (a point former Vice Chair Stan Fischer was fond of repeating).

Second, modern day central banks were built for the purpose of keeping a lid on inflation--they were not built to promote it. The present projected trajectory of deficit-spending will almost surely, sooner or later (Japan notwithstanding), generate inflationary pressure. (If it doesn't, then please just keep cutting taxes and increasing spending.) So again, it seems that the Fed (and the U.S. economy) might be better served by viewing 2% inflation as a soft ceiling--something to defend only in the event that inflation begins to wander significantly and persistently away from 2% (or whatever number one has in mind) in normal times. Let the fiscal authority have the fiscal space it wants/needs as long as inflation remains low.

Recessions, when they hit, tend to appear suddenly and unpredictably. Forecasting the precise date of a recession is a mug's game. Estimating recession probabilities seems more art than science. Perhaps the best that monetary policy can do is to be prepared to act quickly and decisively when the unemployment rate starts rising rapidly. If recent history is a guide, a sharp recession is likely to release a strong disinflationary impulse (related theory paper). In the old days, we might have labeled this a "money demand shock." Today, it is more likely to be described as a "flight to safety shock"--i.e., the safety of U.S. dollars and Treasury securities. I don't think it's particularly helpful to say that high unemployment is causing low inflation--the direction of causality may working in the opposite direction (a high demand for money/debt is causing low inflation). But either way, the appropriate policy response likely entails an accommodating expansion in the supply of money/debt.

"I don't think it's particularly helpful to say that high unemployment is causing low inflation--the direction of causality may [be] working in the opposite direction (a high demand for money/debt is causing low inflation)."

ReplyDeleteInteresting idea, that "a high demand for money/debt is causing low inflation". Any chance the idea would also work for the 1960s & 70s, when the inflation/unemployment trade-off appeared to be a valid explanation of the Phillips curve?

Funny you should ask: https://files.stlouisfed.org/files/htdocs/publications/review/2019/01/14/understanding-lowflation.pdf

DeleteWell, I still think the answer is money-financed fiscal programs whenever (U3) unemployment goes above 4%. Something about building up the federal debt makes me queasy. Why borrow when you can just print?

ReplyDeleteA holiday on Social Security taxes, financed by printing money which is put into the Social Security fund, strikes me as an eminently sensible policy whenever unemployment tops 4%.

A long-term inflation rate around 3% hardly strikes me as a tragedy if the payoff is sustained prosperity. I wonder how many trillions of dollars of economic output have been lost by a fetish for microscopic inflation rates.

You know, macroeconomists were not always like this. I can remember a time when an inflation rate under 4% was considered good enough, and even when Milton Friedman argued the central bank was too tight when the CPI was rising at 3%.