In case you missed it, there's an interesting (and slightly wonkish) debate going on between Olivier Blanchard and Roger Farmer concerning the theoretical relevance of the Phillips curve. Roger fired the opening salvo by presenting a macroeconomic model he claims fits the data well and yet makes no use of the Phillips curve. Farmer, in Laplace-like fashion, declared "he had no use for that hypothesis." Blanchard predictably, and understandably, came to the defense of the orthodoxy:

Let me now review. According to conventional (e.g., New-Keynesian, but also other) theory, there exists a "natural rate of unemployment" that potentially moves around owing to "structural" factors. The long-run rate of inflation is assumed to be fixed by policy in some unspecified manner. In an economy free of any disturbances, actual (and expected) inflation correspond to the long-run inflation target and the unemployment rate corresponds to the natural rate of unemployment. There is also a "natural" (or "neutral") real rate of interest that corresponds to the natural rate of unemployment. Absent any economic disturbances, monetary policy is assumed to set "the" nominal interest rate to its natural rate (the natural real rate of interest plus the inflation rate).

The actual rate of unemployment fluctuates around this natural rate owing to "shocks" that influence the aggregate demand for goods and services. I like to think of these shocks as "news" shocks that cause expectations over the future profitability of investment to fluctuate over time (see, for example, here). It does not matter for my purpose here whether expectations react rationally or irrationally to this information flow. The important thing is when people collectively become more bullish over the future return to investment, the demand for investment rises (at the expense of other forms of storing value, like government paper). For this reason, I attach the conventional label "aggregate demand shocks."

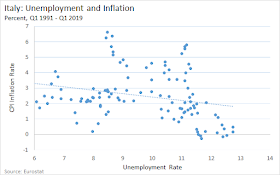

In the conventional model, fluctuations in aggregate demand for fixed nominal interest rate generate a negative relationship between inflation and unemployment. Intuitively, if firms have a bullish outlook, they raise their product prices more aggressively against the higher expected demand, and they also recruit more aggressively as well, which sends the unemployment rate lower. Adjustments in the interest rate (via monetary policy) designed to stabilize the inflation rate would imply movements in the unemployment rate without any corresponding change in inflation. All of this is consistent with the model I present below.

What about the question posed by Blanchard above: "Does anybody doubt that if the Fed decreased (unemployment) to 1%, it would not lead to more inflation?"

It's not entirely clear what experiment he has in mind. An educated guess suggests he's thinking about the Fed temporarily reducing its policy rate, causing a temporary boom in aggregate demand, leading to a temporary increase in inflation and a temporary decline in unemployment, with everything returning to normal once the Fed returns its policy rate to its "neutral" level. My answer to his question is that probably few people doubt this is what is likely to happen. Accepting this, however, does not validate the notion that "low unemployment causes high inflation." (Note: I am not accusing Blanchard of suggesting this causal relation, but many if not most people interpret the Phillips curve in exactly this way).

What I would like to ask Blanchard is the following. What do you think would happen to inflation and unemployment if the central bank lowered its policy rate permanently? I think the answer to this question would illuminate the "natural rate" hypotheses assumed by theorists, as well as what they are implicitly assuming about the conduct of fiscal policy (i.e., how it reacts to the change in monetary policy).

Let me now describe a simple OLG model (a model taught to me by Blanchard via his textbook with Stan Fischer). I will keep the wonkishness to a minimum here. If you want the full-blown version, just email me and I'll send it to you.

Individuals live for two periods in a sequence of overlapping generations. There are young entrepreneurs and young workers. Young entrepreneurs expend recruiting effort to find suitable young workers. The probability of finding a match is increasing in recruiting effort. A match, if it is formed, produces output in the following period. In this sense, recruitment effort is like an investment: a current expense leads to an expected future payoff. For the entrepreneur, the expected payoff depends in obvious ways on the expected productivity of the match (news) and the worker's bargaining power.

Young entrepreneurs face a trade-off: they can devote their resources to recruitment investment, or toward purchasing an alternative store of value in the form of interest-bearing government money (or debt). For a given inflation rate and a given nominal interest rate (both determined by policy), the optimal recruiting intensity trades off the expected return to recruiting relative to the real (inflation adjusted) return on government debt. In a steady-state, the inflation rate in my model is determined by the rate of growth of nominal debt, which is injected into the economy as lump-sum social security payments. The interest expense on the debt is financed with a lump-sum tax on old entrepreneurs.

The aggregate recruiting effort (which I associate with job vacancies) determines the unemployment rate. The model generates a negatively-sloped Beveridge curve. The equilibrium unemployment rate is: (1) decreasing in the inflation rate; (2) increasing in the nominal interest rate; (3) increasing in the bargaining power of workers; and (4) decreasing in the level of "optimism."

There is no "natural" rate of unemployment in this model in the sense of the unemployment rate necessarily reverting ("self-correcting") to a given "natural" rate over a long enough period of time. Monetary and fiscal policy in this model can result in many different "natural" rates of unemployment (and interest). So, in this model, it is indeed possible for policy to drive the unemployment rate to permanently low levels without any inflationary consequences (since inflation is determined by the rate of growth of nominal debt in the long-run).

I should add that the model can speak to the effect of worker bargaining power on inflation as well. A permanent increase in worker bargaining power has no effect on inflation--it simply increases the real wage (and unemployment). In terms of an impulse-response function following a surprise increase in bargaining power, the mechanism works as follows. The increase in bargaining power reduces the expected return to recruiting workers, hence reduces recruiting investment. There is a portfolio substitution out of private investment activities into government securities. The implied increase in the demand for real money balances has the effect of driving the price-level down (for a given stock of nominal debt and assuming no change in the policy rate). So, increased worker bargaining power is disinflationary in the short run, but has no effect on inflation in the long run.

Let me conclude. One purpose of this post was to demonstrate that models without a "natural rate" hypothesis are not that unconventional--I cobbled the model above based on what I learned from standard textbooks, after all. Roger has shown another way to do this that does not stray too far (in my view, at least) from conventional theory either. These models may or may not turn out to be useful ways for understanding basic elements of the macroeconomy and for informing policy--I do not yet know for sure. But I do believe they are worth exploring further and I commend Roger for leading the way!

If you've followed my writings over the years, you'll not be surprised to learn that I am sympathetic to Roger's position in this debate. Below, I explain why. I begin by summarizing the gist of the conventional view. I then present a simple model that has no "natural" rate of unemployment. It's not exactly Roger's model, but it captures what I think is the essential part of his argument.On Farmer. One cannot just ignore an equation (the Phillips curve), and replace it by another. 😩 Does anybody doubt that if the Fed decreased u rate down to 1%, it would not lead to more inflation? P curve relation is complex and shifting, but it is there. Sorry Roger... https://t.co/ewy09sTg7i— Olivier Blanchard (@ojblanchard1) July 26, 2019

Let me now review. According to conventional (e.g., New-Keynesian, but also other) theory, there exists a "natural rate of unemployment" that potentially moves around owing to "structural" factors. The long-run rate of inflation is assumed to be fixed by policy in some unspecified manner. In an economy free of any disturbances, actual (and expected) inflation correspond to the long-run inflation target and the unemployment rate corresponds to the natural rate of unemployment. There is also a "natural" (or "neutral") real rate of interest that corresponds to the natural rate of unemployment. Absent any economic disturbances, monetary policy is assumed to set "the" nominal interest rate to its natural rate (the natural real rate of interest plus the inflation rate).

The actual rate of unemployment fluctuates around this natural rate owing to "shocks" that influence the aggregate demand for goods and services. I like to think of these shocks as "news" shocks that cause expectations over the future profitability of investment to fluctuate over time (see, for example, here). It does not matter for my purpose here whether expectations react rationally or irrationally to this information flow. The important thing is when people collectively become more bullish over the future return to investment, the demand for investment rises (at the expense of other forms of storing value, like government paper). For this reason, I attach the conventional label "aggregate demand shocks."

In the conventional model, fluctuations in aggregate demand for fixed nominal interest rate generate a negative relationship between inflation and unemployment. Intuitively, if firms have a bullish outlook, they raise their product prices more aggressively against the higher expected demand, and they also recruit more aggressively as well, which sends the unemployment rate lower. Adjustments in the interest rate (via monetary policy) designed to stabilize the inflation rate would imply movements in the unemployment rate without any corresponding change in inflation. All of this is consistent with the model I present below.

What about the question posed by Blanchard above: "Does anybody doubt that if the Fed decreased (unemployment) to 1%, it would not lead to more inflation?"

It's not entirely clear what experiment he has in mind. An educated guess suggests he's thinking about the Fed temporarily reducing its policy rate, causing a temporary boom in aggregate demand, leading to a temporary increase in inflation and a temporary decline in unemployment, with everything returning to normal once the Fed returns its policy rate to its "neutral" level. My answer to his question is that probably few people doubt this is what is likely to happen. Accepting this, however, does not validate the notion that "low unemployment causes high inflation." (Note: I am not accusing Blanchard of suggesting this causal relation, but many if not most people interpret the Phillips curve in exactly this way).

What I would like to ask Blanchard is the following. What do you think would happen to inflation and unemployment if the central bank lowered its policy rate permanently? I think the answer to this question would illuminate the "natural rate" hypotheses assumed by theorists, as well as what they are implicitly assuming about the conduct of fiscal policy (i.e., how it reacts to the change in monetary policy).

Let me now describe a simple OLG model (a model taught to me by Blanchard via his textbook with Stan Fischer). I will keep the wonkishness to a minimum here. If you want the full-blown version, just email me and I'll send it to you.

Individuals live for two periods in a sequence of overlapping generations. There are young entrepreneurs and young workers. Young entrepreneurs expend recruiting effort to find suitable young workers. The probability of finding a match is increasing in recruiting effort. A match, if it is formed, produces output in the following period. In this sense, recruitment effort is like an investment: a current expense leads to an expected future payoff. For the entrepreneur, the expected payoff depends in obvious ways on the expected productivity of the match (news) and the worker's bargaining power.

Young entrepreneurs face a trade-off: they can devote their resources to recruitment investment, or toward purchasing an alternative store of value in the form of interest-bearing government money (or debt). For a given inflation rate and a given nominal interest rate (both determined by policy), the optimal recruiting intensity trades off the expected return to recruiting relative to the real (inflation adjusted) return on government debt. In a steady-state, the inflation rate in my model is determined by the rate of growth of nominal debt, which is injected into the economy as lump-sum social security payments. The interest expense on the debt is financed with a lump-sum tax on old entrepreneurs.

The aggregate recruiting effort (which I associate with job vacancies) determines the unemployment rate. The model generates a negatively-sloped Beveridge curve. The equilibrium unemployment rate is: (1) decreasing in the inflation rate; (2) increasing in the nominal interest rate; (3) increasing in the bargaining power of workers; and (4) decreasing in the level of "optimism."

There is no "natural" rate of unemployment in this model in the sense of the unemployment rate necessarily reverting ("self-correcting") to a given "natural" rate over a long enough period of time. Monetary and fiscal policy in this model can result in many different "natural" rates of unemployment (and interest). So, in this model, it is indeed possible for policy to drive the unemployment rate to permanently low levels without any inflationary consequences (since inflation is determined by the rate of growth of nominal debt in the long-run).

I should add that the model can speak to the effect of worker bargaining power on inflation as well. A permanent increase in worker bargaining power has no effect on inflation--it simply increases the real wage (and unemployment). In terms of an impulse-response function following a surprise increase in bargaining power, the mechanism works as follows. The increase in bargaining power reduces the expected return to recruiting workers, hence reduces recruiting investment. There is a portfolio substitution out of private investment activities into government securities. The implied increase in the demand for real money balances has the effect of driving the price-level down (for a given stock of nominal debt and assuming no change in the policy rate). So, increased worker bargaining power is disinflationary in the short run, but has no effect on inflation in the long run.

Let me conclude. One purpose of this post was to demonstrate that models without a "natural rate" hypothesis are not that unconventional--I cobbled the model above based on what I learned from standard textbooks, after all. Roger has shown another way to do this that does not stray too far (in my view, at least) from conventional theory either. These models may or may not turn out to be useful ways for understanding basic elements of the macroeconomy and for informing policy--I do not yet know for sure. But I do believe they are worth exploring further and I commend Roger for leading the way!