The bible credits Jesus with having once turned water into wine. Nowadays, we get to witness the "miracle" of seeing wine turned into liquidity:

Wine Cache Rescues Those Short of Cash.

Some pretty interesting tidbits of information here. For example,

"You'd be amazed by how many wealth individuals have terrible credit ratings. And besides, if you go to a bank, it can take weeks or months to get a loan. When we make a loan, it's usually the same day,'' said Joran Tabach-Bank, head of Beverly Loan Co.

It seems hard to believe that the wealthy individuals he refers to apparently do not have good relationships with their local bank (he includes bankers in this set!). But there you have it.

"Most people have a vision of pawn shops as sad sites. But that's not the case here," Taback-Bank said. "I have a lot of people who come in who have a business opportunity and they need an infusion of cash for business purposes," he said.

Like the banker who can't get the cash loan he needs from his own bank?!

Of course, the business of transforming "illiquid" assets into "liquid" securities is as old as...well, it's as old as banking; see

here. And now that pawnshops are muscling into the shadow banking sector, I wonder how long it will be before they too will be subject to regulatory oversight? After all,

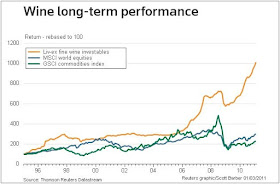

standard monetary theory predicts that assets that suddenly emerge as good collateral objects will be valued above their "fundamental" value; i.e., they will trade a a liquidity premium (which resembles a price bubble).

And, lo and behold! Do I detect a wine price bubble emerging out there?! (

source)

I wonder if the Fed might consider expanding the set of securities acceptable at the discount window to include...um, no...probably won't happen.

Anyway, just having a little fun here before cutting out for the weekend.

Cheers!